Expense Reports

VAT IT Partners With Emburse to Help Companies Save 27% on Expenses

For European companies, submitting claims for Value Added Tax (VAT) refunds is a chore. Fortunately, Emburse and VAT IT have partnered on a joint VAT reclaim solution to help simplify, streamline, and optimize the VAT refund submission process.

4 Tips for Month-End & Year-End Closing That Finance Managers Should Know

Anyone working on a finance team knows exactly how stressful accounting periods are. There are a ton of last-minute requests, unexpected bottlenecks, and unpredictable delays that arise from running both accounts payable and receivables while maintaining the highest quality and compliance standards.

The New Reality of Expense Management Part 3: 5 Questions to Ask Your Finance Team

As previous posts in this series (8 Ways Companies Can Adapt to The New Financial Landscape, Is Now The Right Time to Revisit Your Solution?) have indicated, the reality of corporate travel and expenses has changed drastically due to the ongoing COVID-19 pandemic. Yet despite this worldwide travel upheaval, companies are slowly but surely resuming business travel, while supporting new, remote work options.

The New Reality of Expense Management, Part 2: 3 Reasons to Revisit Your Solution

In the first part of our series on the new reality of expense management, we looked at eight ways companies can adapt to the new financial landscape COVID-19 left us with, including updating T&E policies to reflect remote and hybrid workers, paying more attention to duty of care, and preparing for less frequent, yet more strategic business trips.

How I Did It: Accelerating Change Turnaround Time by 600%

ZS is a professional services consulting firm, with more than 7,000-plus ZSers in more than 25 offices worldwide. In this guest blog, Parikshit Bhatt, associate consultant at ZS, explains how implementing Emburse Solution Administrator boosted helpdesk support and prioritization.

Buy, Pay, Expense: Save Time on Amazon Business Expenses with Chrome River and Mastercard

We are excited to launch a new relationship with Amazon Business and Mastercard that will make the expense process even easier when making business purchases. This is another major step toward our goal of automating the entire expense process.

ERT - Ensuring Even Easier Expensing

At the heart of every expense management solution is the ability to quickly and accurately extract and make sense of the data on paper and electronic receipts. With the launch of Emburse Receipt Transcription for Chrome River, we're using innovations from across Emburse to get to the next level in intelligent expense management.

Making the Best Mobile Expense Solution Even Better

Chrome River has long been viewed as the most comprehensive, most user-friendly mobile solution for expense management. And now we've gone and made it even better!

Gartner Digital Markets Reviews Crown Chrome River the Leader in Expense Management

Gartner Digital Markets uses real reviews from verified users to rate software products. So when its reports list us as the leading expense software solution, we're pretty happy. See for yourself where we stacked up against three of our key competitors.

Why is Your Company STILL Doing Manual Expense Reporting?

We’re in 2019. Cars can drive themselves. You can order niche products on Amazon and have them delivered to your door the same day. You can tell your phone to play some obscure song from your youth that you’ve not even thought about in 30 years. So why are you making your employees do their expenses using tape and printed spreadsheets?

Grab Customers – Welcome to The River!

We're delighted to announce our latest integration partner, Grab. As the biggest rideshare company in Southeast Asia, Grab serves customers in 320 cities across eight countries.

How Manual Expense Reporting is Killing Your Finance Team’s Efficiency

Manually attaching receipts to spreadsheets is a real drudge for business travelers. However, their frustrations pale in comparison to those of the finance team, who have to navigate cumbersome approval workflows, enforce confusing T&E policies, and spend hours manually entering data into their accounting system.

How I Did It: Speeding up Expense Reimbursement with Automated Policy Compliance

Idaho State University (ISU) is a public research university in Pocatello, Idaho. Founded in 1901 as the Academy of Idaho, ISU now has 14,000 undergraduate and graduate students and more than 2,000 faculty and staff. In this guest blog post, Lisa Leyshon, assistant controller at ISU, explains how the university let business flow by automating expense policy compliance and speeding up the approval process, getting reimbursements back in travelers’ accounts much more quickly.

How Can Expense Automation Benefit Your Organization?

New research shows that expense automation technology is firmly in the mainstream, and the majority of organizations that have made the switch have adopted dedicated cloud-based expense automation software. If your organization hasn't yet made the leap, what are the main benefits that you are missing out on?

Playing by the Rules: Why Configurability is Key in Expense Management Choice

One of the biggest benefits that an expense management solution can deliver is automated enforcement of an organization's expense policy and approval processes. However, not all expense solutions have the capability or flexibility to support the requirements of complex global organizations.

Welcome to The River, SpotHero Customers!

Chrome River and SpotHero have teamed up offer an even easier way for business travelers to find, purchase, and expense parking spaces.

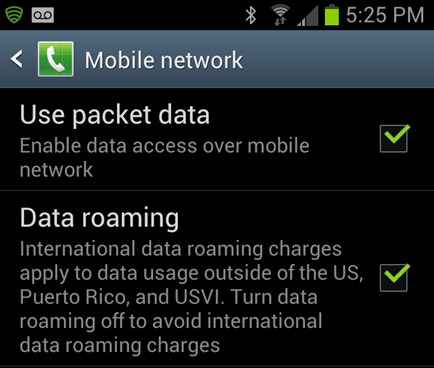

The Four Most Critical Reasons Why Native Apps Don’t Work for Expense Management

There are two approaches to deploying business apps to employees: native apps and web apps. For both approaches, the end-user experience is – at least at first glance – outwardly very similar. However, that’s where the similarity ends, and the inherent weaknesses of native apps soon become apparent.

Putting Expense Solutions’ Optical Character Recognition Capabilities Under the Microscope

Of all the innovations that have made receipt submission a painless part of expense management, the ability to capture receipt images on a mobile phone and upload them directly into the expense solution is one of the greatest. But how do different OCR offerings add up?

Why is Mobility the Foundation of Effective Expense Management in Construction?

The construction industry is more exposed to economic ebbs and flows than almost any other sector of the economy. As a result of this position, construction companies must ensure that they carefully maintain cash flow and cost control, even during boom periods. How can employee expense automation solutions help this?

The Cost-Control Benefits of Analytics in Expense Management

Expense report software solutions can create huge volumes of data on employees' business travel spend. How can organizations use this to make smarter decisions?

7 Steps to Expense Submission Nirvana - Making Life Easy for Your Business Travelers

Expense management systems must provide several receipt submission formats, to match the different types of receipt format in use, as well as users’ own preferences. What types of receipt submission should your expense solution be able to support, to cater to the full spectrum of your organization’s users and their travel profiles?

Chrome River FOLIO: Taking the Headache Out of Hotel Folios

With countless different line items such as food, parking and high-speed internet, hotel folios can be a pain to enter into expense reports - especially when your expense management provider doesn't take info from a certain hotel chain. Chrome River FOLIO solves this challenge with a single click.

Higher Education Expense Reporting: a Unique Challenge

Unlike commercial organizations, whose expenses are funded by operating budgets, higher education institutions’ faculty and research members’ travel and expenses are often funded by grants and scholarships. These funding sources often have a variety of different requirements for how they can be used, and therefore require specific reporting regulations for expenses.

7 New Year’s Resolutions to Make Expense Management a Breeze in 2017

The worst thing about most New Year's resolutions is that they're so easy to break. To make your expense management easier in 2017, here's a list of things that you should not do, along some a couple of one-and-done fixes that will benefit you throughout the year.

Top 10 Perils of Using a Manual Expense Solution

Nearly half of all organizations are still stuck using manual expense reporting systems. If you continue to use paper-based processes instead of an expense automation solution, the risks could easily outweigh any perceived benefits.

How the Olympics Gets me Thinking About Expenses

Unless you live in a cave or have just woken up from a months-long coma, you’ll have noticed that the Olympics are in full swing. However, in addition to marveling at the athletes' exploits (go Team GB!), seeing participants from more than 200 countries and territories competing made my mind spin in terms of the sheer logistics when it comes to the expenses that each team must incur, and how these will all get reimbursed into the currencies used across those nations once everyone returns next week

6 Key Expense Management Best Practices

Whether you are writing your organization’s first travel and expense policy, or you are a corporate travel veteran who has had one in place for many years, it's always good to look outside your own immediate network and see what other world-class organizations are doing to effectively manage their employees’ spend.

Chrome River and Sabre: Making Integrated Travel and Expense Even Smoother

As you may have noticed from today’s announcement made at the GBTA national conference, we are proud to become a Premier Provider of expense reporting for Sabre, one of the world’s biggest travel technology providers. This comes just a couple of weeks after we announced Sabre as the latest travel industry leader to adopt our expense management solution for its own 10,000 global employees.

Chrome River and Traxo Means Even Easier Hotel Expenses

As you may have seen from today’s press release, we’ve just announced an exciting new relationship with Traxo for hotel receipt integration. This will give Chrome River EXPENSE users an even better (and easier) experience when preparing their expense reports, and we’re sure it will be very well received by anyone who’s ever had to manually import or allocate hotel receipt data into their expense report.

Take me to The River

Today, we are excited to unveil a new corporate brand at Chrome River, one that reinforces our commitment to the long term success of our customers, our continuing global growth, and our firm belief that user experience is paramount.

4 Ways to Escape Expense Report Purgatory

Whether you’ve just finished a week-long trip, or if you’ve been stashing receipts all month, doing your expenses can become one of those monotonous tasks that ranks even below timesheets at the bottom of the to-do list. This means that they get put off, and off, and off, until you reach a point where a) you’re broke and need them to be reimbursed so you can put food on the table, b) your wallet is bulging more than your financial controller’s eyes will once they see how much you’re claiming for the past few months, or c) both of the above.

5 Things to Consider When Choosing a Global Expense Management Solution

If you are a global organization looking to upgrade your expense management solution, there is a dizzying array of offerings on the market. Many of the vendors you speak to will tell you that they offer a global solution. However, there’s being able to process the occasional foreign hotel and restaurant bill, and then there’s a true global solution that will work for thousands of end users across dozens of different countries, supporting complex workflows, tax requirements and regional standards.

Why is streamlined expense management automation so critical for law firms?

Let’s face it, we pretty much all procrastinate when it comes to submitting expenses. For most people in the workforce, the biggest pitfall of late expense submission is that you don’t get paid on time, so you may have to cover a credit card bill out of pocket. A bit of a pain, but rarely more than that. However, the impact of this for law firms can be much more far reaching. A tardy submission often results in a write-off absorbed by the firm, since the client will not pay beyond a certain cut-off date. As profit margins at law firms tend to be narrow, losing profits due to poor or delayed expense reporting can be critical.

Seven tips for creating an expense policy that your employees will love (well, almost)

We’d all love to fly first class and eat steak dinners on somebody else’s dime, but if everyone did that, many companies would run out of cash pretty quickly. Therefore, creating a sensible expense policy is a must for any organization to both control costs and, as we recently said in our white paper, reduce business expense fraud. Without a clear policy, staff are left in the dark about what is and isn’t allowed, and will just assume how much they can spend. And we all know what “assume” does.

Small T&E Expenses that Can Make Huge Impact on Bottom Line

Travel and expense managers are likely to keep a keen eye on the big, fat expenses that come with every business trip. However, it’s often the smaller, less costly items that can really start to add up. Flights and hotels typically account for three-quarters of the overall cost of business trips. Ground transportation and auxiliary spending account for the other one-quarter of the costs, and they can be sneaky costs indeed.

Expense Analytics as a Cost Management Tool

Even though we seem to have only recently recovered from the last recession, it looks as though another downturn could be lurking on the horizon. As a result, savvy CFOs and their FP&A teams are keeping a closer-than-usual eye on corporate and personal expenses, in order to conserve funds.

7 Questions Non-Profits Should Ask When Choosing a Travel and Expense Management Solution

One of the most critical issues for any non-profit is maintaining a close eye on spend. One area where things can get out of hand if not managed carefully is employee (and non-employee) expenses – everything from operational items like paper for the office printer, to airline tickets and hotel stays.

Must-Knows About the High Price of Travel Expense Reimbursement

Your corporate travelers are the face of your company, representing you far and wide. But when you fail to reimburse them in a timely, fair and efficient manner, you could be paying a high price indeed.

Why You Need Reporting and Analytics in Your Purchase-to-Pay (P2P) Automation

Innovative companies of all sizes and types are turning to Purchase-to-Pay (P2P) automation to enhance efficiency, reduce costs, and increase visibility and control of their spending. Once they decide on P2P as a solution, however, they still have to ascertain which specific tool from which specific provider will best suit their needs.

Aspirin for a Headache? Try Automating Expenses Instead.

Automating your expense management process cannot only save tons of headaches, but it may be able to save your company more than 10 percent of its non-salary operational expenses. At least that’s what Bank of New Zealand (BNZ) Chief Executive Anthony Healy discovered reviewing his company’s formidable mid-year results.

Bribes, Speed Money, Extortion, Expense Reporting Fraud

Bribery and fraud are not words you want associated with your company, but avoiding them may not be as straightforward as you think. Corruption doesn’t always come barreling in like a freight train. It can slither in like a snake, striking when you least expect it and are least prepared to handle it. A recent piece in McKinsey Quarterly examines the most common types of corruption companies can face in the global marketplace along with actions they can take to keep it at bay.

Anything Worse Than Expense Fraud? Well, Yes

Expense fraud is bad, but it’s not the only way or even the worst way companies can get scammed. The annual Association of Certified Fraud Examiners report revealed nearly 50 percent of small businesses eventually fall prey to some type of fraud. Each instance averages $114,000, and is usually pulled off by a trusted employee.

Expense Fraud Costs Companies Millions

A little padding of the corporate expense account can add up to a lot of lost cash, as evidenced by a report from Oversight Systems. The report found companies lost nearly $14 million due to fraudulent expenses filed in 2014 – and that was a loss calculated over only a 90-day period. Do the math to estimate losses from expense fraud over the entire year, and annual losses climb to more than $50 million.

18 Days and $36 for an Expense Report? That’s Cray Cray!

We tend to assume that technology will help speed up whatever we’re doing, right? We can share photos with our families and friends in seconds rather than days, shift money from one account to another without stepping inside a bank, and so on. But sometimes the reverse is true of technology—think of how painful it can be to navigate through a complicated voicemail system.

Four Amazingly Lovely Things About Expense Management Software

Money, money, money! Where does it go? Keeping track of expenses can be a challenge, and it's vitally important for any organization to keep a close eye on the outflow of funds. However, training staff to track expenses can be tricky, especially when it's done manually. When your expenses aren't tracked properly, it costs your organization time and money. Using expense management software can make your staff feel much more financially savvy and will help control your expenses.

Teenagers Get the Mobile Mindset. Do You?

Mobile solutions have become critical in integrating business and technology. If designed and executed effectively, they have the ability to speed productivity, simplify the user experience, and offer added convenience to end users. However, just adding mobile isn't going to do much by itself. You need to develop a mobile mindset, thinking about how innovative mobile solutions will enhance your business model at every level of your organization without causing disruptions and distractions.

Expense Reporting: Don’t Manage Every Nickel and Dime

If the news that close to half (42%) of the 958 travel managers polled in the 2014 AirPlus International survey are bracing for significant increases in travel costs has you tempted to go back to micromanaging every nickel and dime – doling out travel vouchers like they were a precious commodity – you might want to rethink that strategy.

Executive Survey - T&E Expenses near Top of ‘Hard to Control’ Costs

Earlier this year, Forrester Research surveyed 348 financial decision-makers around the globe regarding corporate expenses. Almost a quarter of executives tallied indicated that Travel & Entertainment (T&E) expenses were one of the top three most challenging operating expenses to control - second only to maintenance expenses.

3 Ways Mobile Accounting Tools Can Give Your Organization A Boost

Finance departments already routinely use online platforms to collaborate and communicate with users. Now, new mobile apps are proving useful for employees who work on the go, an article on AccountingToday.com reports. Whether your organization needs online expense reporting, document access or just a quick way to look up data, a mobile app may offer the most convenient connection to your accounting department.

Why Expense Reporting Must Be Simple

For growing companies, keeping up with ever-evolving technology is a core objective. The key to successfully executing on that objective is to ensure that the changes being implemented will be adopted by employees. With computer literacy levels varying dramatically within an organization, driving that adoption is easier said than done. Expense report approval and reimbursement is one of the processes for which forward-looking businesses have turned to technology in order to cut costs, speed turnaround time, and increase data reportability. Such companies recognize that the process of shuffling paper receipts from desk to desk for approval and allocation is no longer a viable solution. They also recognize that most home-grown systems can't offer all the functionally and analytics offered by vendors that focus exclusively on expense reporting. Recognizing the need for and role of technology in dramatically improving the expense reporting process is a great first step. The daunting task then becomes finding a differentiating factor in the solutions that are available. The key factor to focus on is how much effort it will take to get users to adopt the system. Keep in mind that there are valuable people in an organization who aren't as computer savvy as others.

Chrome River Currents Monthly Digest—05.26.2013

Welcome to the Chrome River Currents monthly digest! Each month we highlight the latest news and analysis on business travel, expense management and online expense reporting. This month, we’re focusing on helping organizations use cloud-based software in tracking business expenses. We offer tips on using analytics and mobile tools, and introduce our four-part series on reporting travel and entertainment expenses under an IRS accountable plan.

Do You Know Which Airline has the Most On-Time Flights?

On a recent US Airways flight, we pulled into the gate later than our expected arrival time. The flight attendant, no doubt in an effort to sound considerate, asked everyone on the plane to please let those passengers trying to make connecting flights disembark first. I thought, ‘What a ridiculous request! Though I’d be more than happy to oblige, how will the rest of the passengers—all of whom will be jumping out of their seats as soon as we come to a stop—know exactly who among us meets that requirement? Would it be the people who look exhausted, flushed, nauseated or annoyed? That would include everyone!’

Have You Experienced Mobile Sticker Shock?

Depending on your company’s policy, you might find expense reimbursement for mobile phone bills to be one of the most contentious topics for expense approval. Most companies have a cap on what they will reimburse each month, and it’s not unusual for employees to accidentally get hit with a bill that is way beyond what they expected.

Keep the Bottom Line Strong by Streamlining Expense Management

There isn’t a business out there that isn’t looking to find a way to operate more efficiently. After all, in the current economic climate, keeping a close eye on the bottom line is more important than ever. You can’t afford to let any efficiency-maintaining opportunity to cut costs slip past. Whether you’re the CEO of a major corporation or operating your own small business, you’re probably looking for ways to streamline your expense management. One of the best ways to do this is to make sure that you have control over who gets to use an expense account and which items are permissible. Too often, companies neglect to ensure that only authorized expenses are reimbursed. It might not seem like much when the costs are only a couple of dollars, but when those dollars are multiplied by various individuals over the course of a year, it can mean a substantial loss. By making sure that you’re controlling what is allowed, you’ll help ensure your bottom line stays strong. If you find that employees are failing to comply, you can provide them with concrete information on reimbursable vs. out-of-pocket expenses. Another way to streamline expense management is setting up an expense overview schedule. Every quarter, take some time to go over the year-to-date expenses, find out which areas are costing the most, and make adjustments accordingly. For example, if you find that lodging is costing more each quarter due to price increases on the hotel end, you can research comparable lodgings at a lower cost. By reviewing expenses on a regular basis, you’ll make sure that you’re not caught off-guard by cost overruns. One of the most effective ways to cut costs and save time is to automate your travel and expense reporting system with a product like Chrome River EXPENSE. Your company might be spending too much time and creating too many problems by using outdated expense reporting procedures. Chrome River EXPENSE shows employees precisely how much they can spend, which expenses will be covered, and when an expense falls outside the guidelines for reimbursement. Having an automated expense system allows you to easily submit expense reports, analyze spending data, and produce proper documentation when it comes time to submit annual budgets and file tax returns.

Don’t Get Shortchanged on Business Mileage

If you have to travel for your job, you’re probably very aware of how important it is to keep track of your business mileage. You might think that you’re keeping a close eye on the miles, but you might actually be losing money on your travels. To make sure you don't get shortchanged on business mileage, there are a few things you can do to protect yourself. The simplest method of tracking mileage is, of course, good old-fashioned pen and paper. Write down your car’s mileage when you start your trip and when you end it. Or leave yourself voicemails, or send yourself text messages. Of course, things get complicated if you have more than one destination or need to exclude portions of the trip that were not business related. In today’s technologically advanced world, it seems there’s an automated answer for everything. Now, many business travelers use Google Maps to determine the mileage they have traveled. In fact, Chrome River EXPENSE includes Google Maps functionality for calculating mileage for expense-reimbursement purposes. Simply enter the starting and ending addresses for your trip, and Chrome River will automatically calculate how much you should be reimbursed, based on your organization’s rules. You can also calculate mileage between multiple destinations and exclude personal mileage, if necessary. The key to making sure you don’t get shortchanged on business mileage is to keep accurate records. Whether you use a notepad, send a text message to yourself, leave a voicemail on your office phone, or let Chrome River’s Google Maps widget do the work, the important thing is that you make sure you have an accurate record. Doing this prevents problems during an in-house audit and provides useful information when travel budgets are being created for future use.

Ways to Conquer Budget Challenges in Higher Education

Budget cuts and challenging economic conditions have required higher education institutions to tighten their belts even further by closely examining budgets and scrupulously tracking spending. Universities are under immense pressure to demonstrate the true value of travel and expense budgets, while at the same time finding innovative ways to control those costs. With so many different people and groups within an institution incurring business expenses, keeping up with specific policies, spending limits and complex allocations can be overwhelming. Unlike other businesses, many institutional expenses are funded through grants or special budgets, which must be accurately allocated and meticulously tracked. Serving the needs of institution administrators, full-time faculty, athletic coaches and authorized guest travelers, higher education truly has unique travel and expense needs.

Crazy Business Expenses

In business travel, most expenses are fairly routine matters and handled by the book. Airfare, hotel, rental car, taxi rides and meals. However, what about when an employee expenses, say, a goat? Unquestionably, these animals have been allies to humans for millennia, but it’s hard to envision a goat’s role in the context of, say, an onsite software installation.

Ways Automated Expense Reporting Can Contain Rising Airfare Costs

For casual travelers, the way airlines set fare prices can seem either arbitrary or a conspiracy that combines magic and higher mathematics. But fare prices do follow predictable trends, at least for corporate travel managers. This year, increased demand is expected to drive up airfares for business travelers.

3 Benefits to Travel Expense Management

Some businesses fail to see the benefits of travel expense management. They feel that their employees are on the straight and narrow and don’t believe they need to spend any time or effort dealing with travel expense management. Some of these businesses believe they are too small to benefit from this kind of expense management, but no business can afford to ignore any potential area where money or time might be lost.

Don’t Guess About Sound Practices for Expense Management

Anyone involved with business knows the best practices for expense management are the ones that require the least effort. When a practice is too complicated or too time-consuming, business owners have found their employees tend to be lax in making sure they are following procedure.

3 Tips to Successfully Manage and Control Employee Expenses

Managing employee travel expenses can increase the productivity of your employees and can increase management’s visibility into expenses in a timely manner. Below are three ways to help control and manage your expense reporting process.

Should New Year’s Resolutions Include a New Expense Policy?

With the New Year rolling around, companies are looking at ways to make 2013 more profitable and efficient. It’s the time of year when you might be wondering what sort of New Year’s resolutions to make regarding your business.

8 Egregious Expense Report Abuses

It seems like there are some people who not only take their expense accounts for granted, but also flagrantly misuse them to the extent that it’s fraud. Read about some eye-popping expense reports that baffle the mind – as in – what were they thinking?

Empower Employees with Mobile Solutions to Improve the Bottom Line

Now that there is an app for nearly every conceivable function, companies have realized that their second largest expense, travel, can be fully automated – bringing a new level of insight, analysis and negotiation to the ubiquitous expense report. Gone are the days of paper, calculators and spreadsheets for the tedious yet mandatory task of reimbursement. In their place are flashy smartphone apps that track the traveler’s location and purchases and create expense transactions automatically. These mobile solutions are linked to cloud-based expense management systems that provide immediate feedback to the employee when policies have been breached. They also provide high-visibility notification for approvers when compliance conditions are not met, allowing firms to exert greater control over their operating expenses to adhere to client requirements and firm policies. Requiring employees to manually complete expense reports, which not only wastes time but also drives up costs through lost productivity and increased staffing, is no longer a viable option. In today’s economy, it’s either increase productivity or suffer reduced profitability.

Learn How Big Companies Streamline AP Automation and Expense Reporting

Those big guys have it made. Large companies have the ability to invest in consultants and analysts to streamline their accounts payable (AP) and expense reporting processes so they can process much more volume in a short amount of time. If only there were ways for small and medium-sized businesses to take advantage of the same capabilities. It would level the playing field and more than likely reduce some operating expenses in the process.

8 Key Tips for Business Travelers

After many years as a road warrior, I have noticed that I’ve developed patterns and routines in my business travel to help maximize my efficiency and minimize my stress. If you asked my wife, she might just chalk it up to my being OCD in nature, but these simple tips are now part of my business travel routine:

The Data Behind Expense Key Performance Indicators

The way to drive performance is to measure it. Do you want to judge the success of a project? Do you want to change people's behavior? You need to create Key Performance Indicators (KPI) that quantify the objectives you are striving for. Your KPIs may change from project to project and from year to year. But they should be consistent in their ability to measure the success or failure of any set of activities.

A Stranger Among Us

World-renowned Italian artist Franco Innocenti lives in what remains of a 10th century castle tower and paints the world as he sees it. His paintings reveal a reality different from the one to which we are accustomed, as Franco removes objects from their natural environments and places them in completely unusual surroundings, creating absurd combinations that reveal paradoxical aspects of the world around us.

Automated Invoicing: 3 Ways It Can Improve Efficiency

In any business there are specific questions that should be part of every continuous improvement plan:

Hey Diddle-Diddle the Expenses Fiddle - Harry Townsend

The breaking news that the Labour Member of Parliament for Rotherham, Denis MacShane, is facing a 12-month suspension from the House of Commons for submitting false invoices that were “plainly intended to deceive” highlights the constant diligence required of organisations to monitor and control their expenses and incoming invoices.

This was also the subject of a September survey that found nearly one-third of 1,000 UK employees who took taxis for work admitted that they routinely cheated on such expense claims. The people polled indicated that they added to the taxi bill or expensed fares that were not business related.

"Taxi Receipt" Photo. Ebay.co.uk 10 Jun. 2012. 06 Nov. 2012

Why Your Organization Can’t Risk Expense Report Inaccuracies

Few would argue with the truism “Numbers don’t lie,” but inaccurate numbers can and do lie all the time. A good example is the vast number of inaccurate numbers that can enter an organization’s financial system via expense reports. Organizations that allow employees to write or type expenses into a form that is manually reviewed and re-entered into the accounting system by a staff member have introduced several opportunities to enter inaccurate information for each transaction.

Learn What Your Expense Report Says About You

The quality of your expense reporting speaks to the type of worker you are. Do evaluations reflect frugal or flighty spending, careful or careless tracking, a dinged or distinguished history? Too many tallies in the wrong category can echo negative opinions about professionalism and work ethic. When it’s read in black and white, what do expense reports say about you?

Top 5 Productive Ways to Spend a Flight Delay

For many business travelers, airline travel is the fastest way to get from Point A to Point B, unless a flight delay upsets a perfectly crafted schedule, leaving unplanned downtime in place of progress. Use the interruption to your itinerary to get a head start on pre- or post-travel agendas by putting these efficient business-travel tips into practice.

9 Best Practices for Automating your AP Department: Part 2 of 3

In this second part of a three-part series, we will resume our discussion of Accounts Payable Best Practices (Part 1) fueled by an excellent article entitled "9 Best Practices for Automating Your AP Department," written by David Schmidt and Katie McMurry. Their work appeared in the Third Quarter printing of Financial Operations Matters and provides an excellent road map for automation that is both commonsensical and actionable.

9 Best Practices for Automating your AP Department: Part I of 3

Recently I had the good fortune to stumble across an excellent article entitled "9 Best Practices for Automating Your AP Department" in the third-quarter printing of Financial Operations Matters. This little gem was written by David Schmidt and Katie McMurry and offers a viewpoint on AP Automation that is very much aligned with my own personal opinions on this topic.

The Secret Of Breaking the Spreadsheet Cycle

Spreadsheet expense reporting can be overwhelming, stressful and downright confusing for everyone involved. With so many people playing a role in the reporting and accounting process, some expenses may be recorded twice, while others may never be documented at all. Fortunately, you can break the usual spreadsheet cycle with a single tool: the online expense reporting program.

End-of-Year Expense Reports: 10 Tips for Getting a Head Start

End-of-year expense reports are extremely important for any business. Using the information on your report, you can complete your tax return, analyze your profits, and plan for the following year. However, too many business owners wait until the last minute to start compiling information for this essential document. Below are 10 tips you can use to get a head start and ensure that you don't miss anything important.

4 Sure-Fire Tips to Lower Your Law Firm’s Business Expenses

There are plenty of hurdles for firm owners to jump while running a competitive law practice without tripping over excessive operational costs. It’s a fast-paced industry that requires resourcefulness and refined spending habits. Simplify saving with these tried-and-true tips that help keep budgets on track and goals within reach.

3 Must-Have Apps for the Savvy Business Traveler

A finger tap is all that’s needed to take advantage of these top business travel tips. Plan, organize, track and process information anywhere, anytime. And with these savvy smart phone apps, you'll look cool, calm and collected while doing it.

How Travel Expense Tracking Helps Keep Your Budget on Course

It is difficult to determine a business budget without first looking at the spending trends that help to create it. Being aware of business travel expenses is imperative to trip planning, and careful tracking is an infallible method of keeping those travel budgets on the right course. A little tracking can go a long way! After all, travel and expenses makes up about 10% of your operating budget.

Your Employees are Padding their Travel Expenses

Are your employees cheating on their corporate travel expense reports? About 80% claim that they are generally honest with their travel expense reports but some admit to skimming a little of company funds for various reasons. Your employees represent your company on the road. And, their occasional unethical practices should be minimized, if not eliminated.

How to Leverage Your Expense Management Software

I had the opportunity to deliver a best-practices webinar with Information Builders, a leading provider of Internet-based business intelligence and reporting solutions. They also provide the technology behind Chrome River ANALYTICS, the management reporting module within the Chrome River expense management software suite.

Search

Subscribe

Latest Posts

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.