Anyone working on a finance team knows exactly how stressful accounting periods are. There are a ton of last-minute requests, unexpected bottlenecks, and unpredictable delays that arise from running both accounts payable and receivables while maintaining the highest quality and compliance standards.

The truth is that managing spend is a constant 24/7 cycle. Every single month, quarter, year, etc., reports need to be generated, stakeholders have questions that need answering, and there always seems to be yet another audit in the works. Managing spend is an ever-present concern.

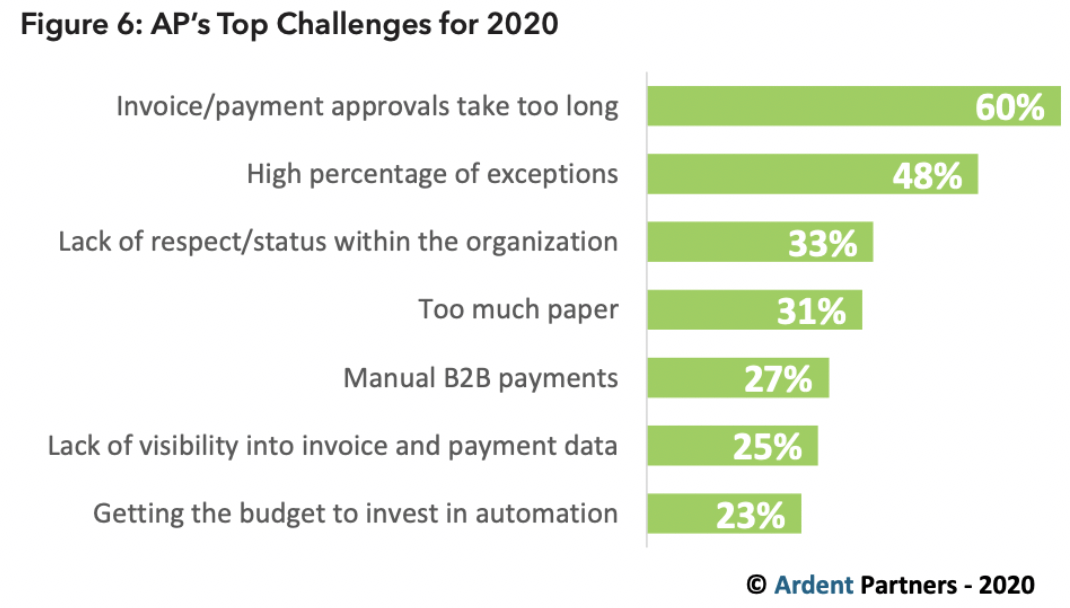

In a 2020 Ardent Partners survey, organizations reported that invoice payment approvals and a high percentage of exceptions were the two most significant challenges for AP teams. Not too surprising.

If you want to improve efficiencies and reduce expense cycles, you need to avoid the most common bookkeeping and accounting problems that all AP teams face—from small businesses to multinational corporations.

Month- and year-end closing tips and tricks

All too often, expense and AP teams continue wrestling with bloated legacy systems and outdated, unwieldy workflows that make generating accurate monthly and quarterly reports a nightmare.

The role of every accounting team is to keep track of spend as accurately and efficiently as possible, but they can’t do that if they’re stuck relying on systems designed for the ‘90s. Here are four tips for finance teams looking to modernize their closing process:

Tip #1: Implement formal training to pass on internalized knowledge

If it turns out that a specific member of your finance team (like the CFO or Comptroller) has to review every invoice, transaction, approval, etc., it’s likely that far too many of your checks and balances exist only in that employee’s head. That is never a good thing, and it always leads to endless delays. Worse, that key employee may one day leave.

A lack of adequate training documentation and mentoring programs should never be a reason your entire finance department is stuck in limbo. Yet this is a surprisingly common problem for companies of all sizes.

If you don’t already keep well-documented accounting, expense management, or AP training documentation for junior team members, maybe it’s time to write it all down. Sharing senior expertise and experiential wisdom not only ensures new hires are doing their jobs efficiently, it also frees up time for senior decision makers (who are no longer bombarded by non-stop questions).

Learn more: Using Smart Auditing to Outfox the Expense Fraudsters

Tip #2: Identify existing bottlenecks in the closing process

When you’re entrenched in a decades-old methodology, it’s very easy to miss the forest for the trees. Sometimes, the fastest way to smooth out inefficiencies is to take a moment to stop, reflect, and think about what you’re doing. Before your next monthly or quarterly closing, get the team together and ask yourselves the following questions:

- How much more time do we spend on reconciliations during closing periods compared to the rest of the month/quarter/year?

- Are we regularly reconciling our accounts, or do we scramble to get financial statements and reports in order during closing periods?

- How can we better distribute or reduce the time we spend on reconciling accounts?

- Who, if anyone, is a bottleneck for approvals and audits?

These questions may not be easy to answer. Identifying useful answers will probably be a team effort. But asking them is the first step towards streamlining all future closing periods.

And because finance teams can be siloed based on function, they’re often slowed down by bureaucracy. In such an accounting environment, expense managers are usually building reports based on slightly outdated numbers. Even worse, the numbers they have may not be accurate (e.g., missing transactions, unreported spend, input errors, etc.).

This is why automated expense management solutions and systems are so critical to proper expense reporting and bookkeeping.

Tip #3: Automate as much of your closing process as possible

The most effective way to improve the closing process is to invest in a solution that removes the common pain points through automation. Modern, cloud-based SaaS solutions enable AP teams to focus on adding value instead of manually diagnosing errors with cumbersome legacy systems.

With the right automations and customizations, finance teams will not only be able to automatically collect and reconcile transaction data in real-time, but they will also have access to automatically generated reports that flag potentially fraudulent or suspicious payment activity.

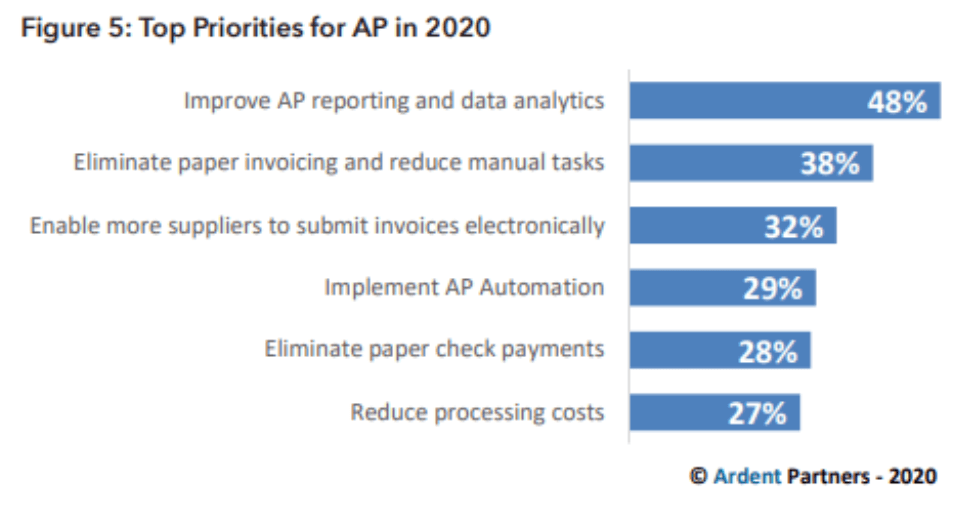

Ardent Partners found that the top priority by far for AP teams in 2020 was to improve AP reporting and data analytics, with almost half of respondents citing it as a critical priority. The good news is that automated expense management solutions are designed to capture all transactions and reduce human error.

Cleaner data leads to improved trust from management due to better visibility, more valuable insights, easier collaboration and consensus, and lower costs. In our rapidly evolving workplace, McKinsey makes it clear that companies willing to embrace new technology will be positioned to succeed for years to come.

Learn more: Unify the invoice-through-pay process

Tip #4: Fine-tune each step in the process

Month-end closing is an excellent opportunity to test new methodologies and workflows. While no two months are the same, month-end closing is a predictable process that should run like a well-oiled machine, with tight schedules in a precise sequence.

Once you work out the kinks in your month-end closing process, quarter-end closing won’t be the boogeyman it used to be. While the end of each quarter comes with bigger stakes—more consequential reports, decisions, and consequences—your quarter-end closing process can benefit from the same optimizations you made to month-end closing.

In the high-stakes world of B2B payments, it also pays to be prepared for any and all eventualities. The COVID-19 pandemic, for example, caught travel and expense (T&E) managers off guard worldwide. They were forced to rethink and fine-tune their payment processes to stay ahead of the competition.

Bookkeeping shouldn’t be nerve-racking

While month-end and year-end closing is an unavoidable part of the expense and AP management process, it doesn’t have to give you a headache. We’re not living in the ‘90s anymore. You aren’t beholden to Excel. There are far better options out there.

COVID-19 brought these decades-old issues to light. The pandemic was a big wake-up call that presented new challenges and opportunities for finance departments. Only 3% of surveyed organizations interviewed by Ardent Partners in 2020 said the pandemic had no impact on their AP function, with 28% reporting a high impact.

Adaptive and automated expense management systems are the only way to keep up with global teams, vendors, and payments on a 24/7 cycle. Take your organization’s spend management capabilities to the next level in 2022!

Schedule your Spend Optimization Assessment today!

Search

Subscribe

Latest Posts

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.