In the first post in this series, we looked at how the COVID-19 pandemic has impacted the global travel industry and how corporations have responded to flight and meeting restrictions. In this post, we’ll take a look at how travel and expense management teams, in particular, have been affected by the seismic shift in business travel.

For over half a century, millions of people have been flying between cities and across borders to meet potential clients and close deals. Most of us are so accustomed to the rinse-and-repeat ritual of business travel that we couldn’t imagine going a whole year without seeing the inside of an airplane.

Yet that’s exactly what happened to all of us for well over a year. According to the Wall Street Journal, by the end of July 2020, itineraries purchased by corporations were down 97% year over year. Within a few months of the COVID-19 outbreak, business trips simply disappeared.

But as worldwide vaccine rollouts continue and global restrictions are lifted, travel is slowly coming back. And as summer travel warms up, international and domestic bookings are on the rise. The EU recently eased travel restrictions for non-Europeans, which resulted in a 47% surge of trans-Atlantic airfare searches.

Business travel is coming back, too. According to Allison Taylor, chief customer officer at American Airlines Group, 47 of the airline’s 50 largest corporate accounts plan to resume business travel this year. Yet corporate travel is still 70% or more below pre-pandemic levels.

Get ready for a travel comeback

For travel and expense management teams, this slow-but-sure recovery may be a blessing in disguise. In the downtime of 2020 (and much of Q1 2021), finance teams had the better part of four quarters to rethink business travel as a way of doing business. They’ve also had ample time to review their travel and expense management process and solutions.

In this brave, new, post-pandemic world, how should corporations best prepare teams for business travel? How often will trips take place, and what will their purpose be during a remote work renaissance? What can organizations do to better optimize travel spend, reconcile on-the-go expenses, and offer adequate duty of care for travelers in 2021 and beyond?

These are great questions. Let’s see what the answers might be.

Travel & expense management after COVID

1. Fewer but more important trips and travelers

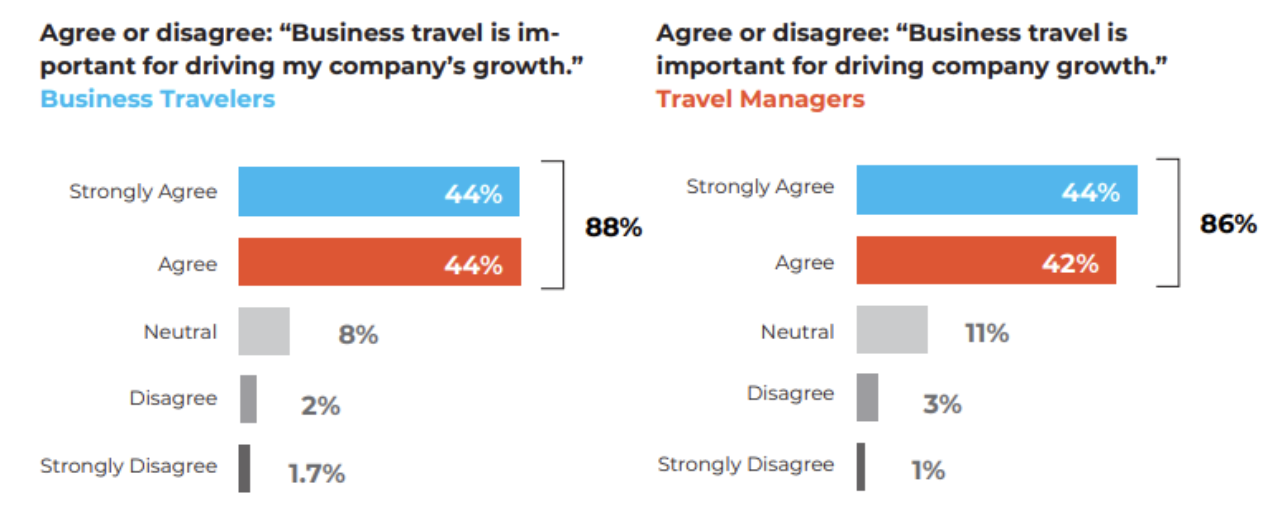

According to the 2021 State of Corporate Travel & Expense report by Skift, 88% of surveyed business travelers agreed or strongly agreed that “Business travel is important for driving my company’s growth.” Similarly, 86% of surveyed travel managers agreed or strongly agreed that “Business travel is important for driving company growth.”

Despite the rise of remote work, business travel isn’t going anywhere.

Despite nearly a year cooped up and working from home, many people still believe business trips are the best way to achieve successful business outcomes. That being said, many employers also realize just how much money they saved last year by not having to pay for offices or business trips.

This could go any number of ways. On the one hand, the cost savings from a slimmer in-person workforce could translate directly into more budget for strategic business travel.

On the other hand, given continued complications with COVID, it’s more likely that companies continue to scrutinize the merits of meeting in person. They may commit more budget to fewer, higher-value business trips. As-needed trips will not happen as frequently but will require more resources, more training, and cost more per trip and traveler than before.

In other words, expect fewer travel suppliers and fewer travel managers. Travelers ultimately win as suppliers compete for the few remaining frequent flyers. Trip approvals will hinge on the importance of in-person meetings over virtual ones and the potential for on-the-ground network effects and interpersonal dynamics that may not happen otherwise.

2. Less focus on travel prices and cost savings

How do we know that there will be fewer business trips booked for the next few years? The best evidence is traveler inertia due to the pandemic:

While most people agree business trips are essential, that doesn’t mean they want to go.

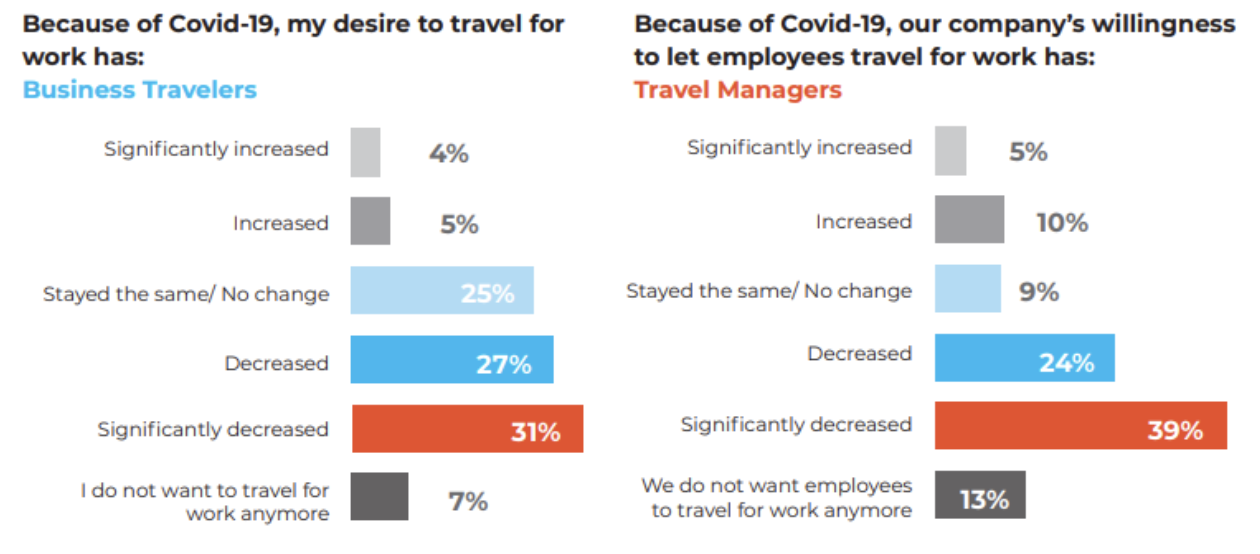

Skift also found that up to 58% of business travelers and 63% of travel managers are now less willing to travel for work or let employees travel for work.

In a future with fewer but more important trips, T&E will turn their noses up at frivolous expenses and travel requests. They’ll also open their checkbooks for meetings that are pre-approved and deemed necessary. Airlines, in turn, may recognize the price inelasticity of these “VIP trips” and capitalize on the situation by raising prices across the board for business travelers.

Businesses may not mind all that much. After all, when the name of the game was volume bookings, negotiating cost savings was priority number one. But when booking flights during a pandemic—with savings already baked into the lower frequency of flights—buyers may shift their attention from pricing to optional add-ons, customer service, and the overall quality of their supplier relationships.

3. More focus on optimizing meeting and traveler outcomes

To be clear, we don’t expect finance teams to write blank checks for business trips that need to happen. But we don’t think they’re going to be as interested in nickel-and-diming suppliers. Instead, they’ll do everything in their power to streamline and optimize travel, accommodations, meetings, and outcomes.

For some companies, this could mean revamping outdated, legacy technologies and solutions. According to a New Center’s 2020 Expense Management Report, only 19% of finance professionals cited their current expense management processes as "smooth sailing" in 2020, down from 26% in 2019. Even worse, 40% of finance teams still use unwieldy, error-prone spreadsheets for expense management.

For companies that already use an enterprise-level T&E management platform, it could be time to review the technology stack. For example, better trip budgeting requires pre-approvals that let travel managers track spend before it happens. With a modern T&E management solution, employees could be given the power to create requests for categories such as airfare, hotel, meals, and rental car services which route automatically for approval.

They could also help simplify expense report creation and submission with mobile-friendly receipt capture and reimbursements for on-the-go documentation. The ideal receipt capture solution should be flexible, offering multiple methods for uploading receipts that stay mindful of how data is extracted from different mediums. A solution that uses OCR (optical character recognition) to read receipts and populate expense reports automatically will save a ton of time.

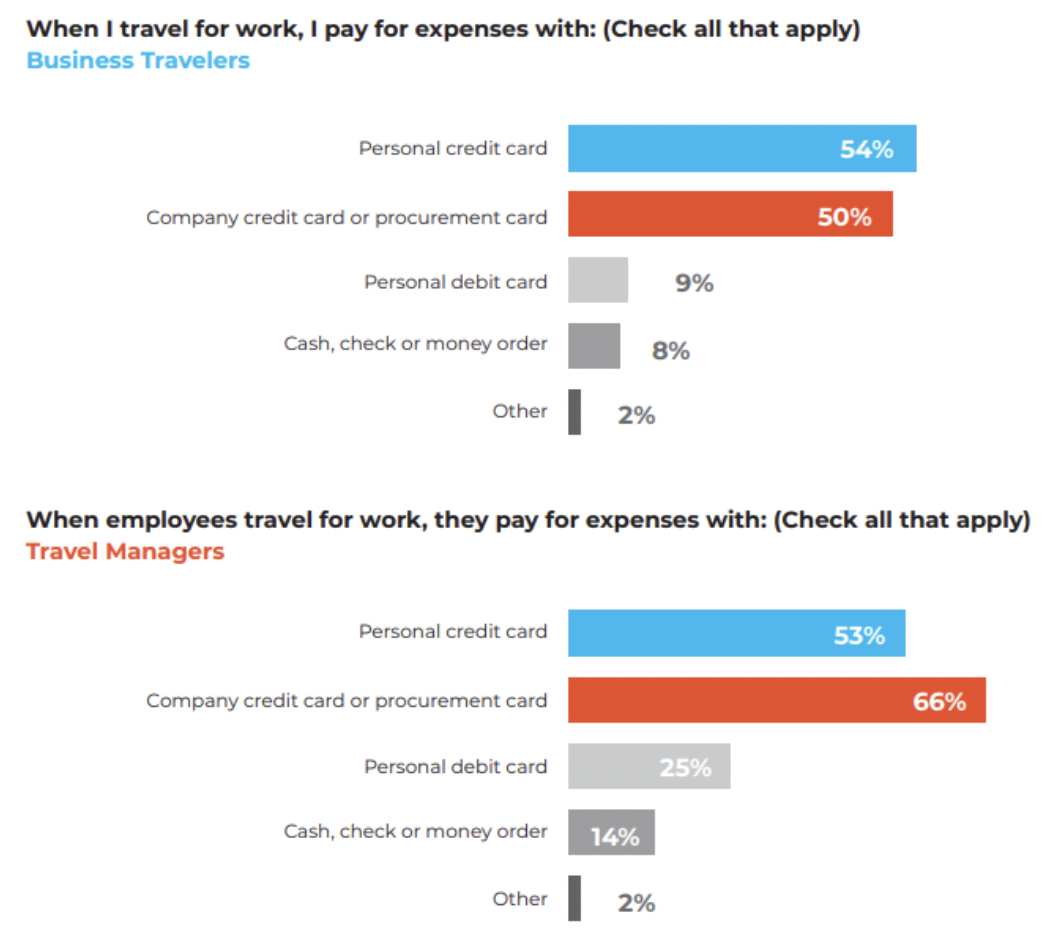

Finally, no traveler likes having to put company bills on their personal credit cards (reimbursements can be such a pain). Yet this still happens nearly all the time.

We’ve all paid for more business expenses than we wanted to with personal credit cards.

However, with an integrated card issuing platform, companies can supply every traveler with a pre-funded card tied to their travel expense account. Employees can also connect personal cards to a pre-approved business trip for faster reimbursements. This kind of flexible spending not only offers greater visibility into upcoming expenses but also ensures travelers feel adequately taken care of.

4. More attention will be paid to duty of care

In late 2020, the World Health Organization published a Pandemic Fatigue guide. Although duty of care leaders were not the intended target audience, they may as well have been. Never before has duty of care been so talked about or written about in the travel industry. But COVID-19 hit a nerve with everyone, especially business travelers.

For some companies, duty of care may not have been high on the T&E priority list. It was likely an afterthought consigned to legal and compliance. But in the wake of the pandemic, duty of care considerations are suddenly mission critical. If you want to send any of your employees to another country right now, you better know what you’re getting them into.

No one will feel comfortable traveling for business unless they know they’re being taken care of.

But duty of care doesn’t have to be another hurdle travel managers need to jump through. In fact, duty of care could actually open up potential avenues for cost savings. As an example, your company could potentially restrict traveler expense categories to what's considered “safe” at any given destination.

In case you were wondering, the WHO Pandemic Fatigue guidelines include the following recommendations:

- Collect and use evidence for targeted, tailored, and effective policies, interventions, and communication.

- Acknowledge that wide-ranging restrictions may not be feasible for everyone in the long run.

- Find ways to meaningfully engage and involve individuals and communities (i.e., employees and teams of employees) at every level.

- Acknowledge and address the hardship people experience and the profound impact the pandemic has had on their lives.

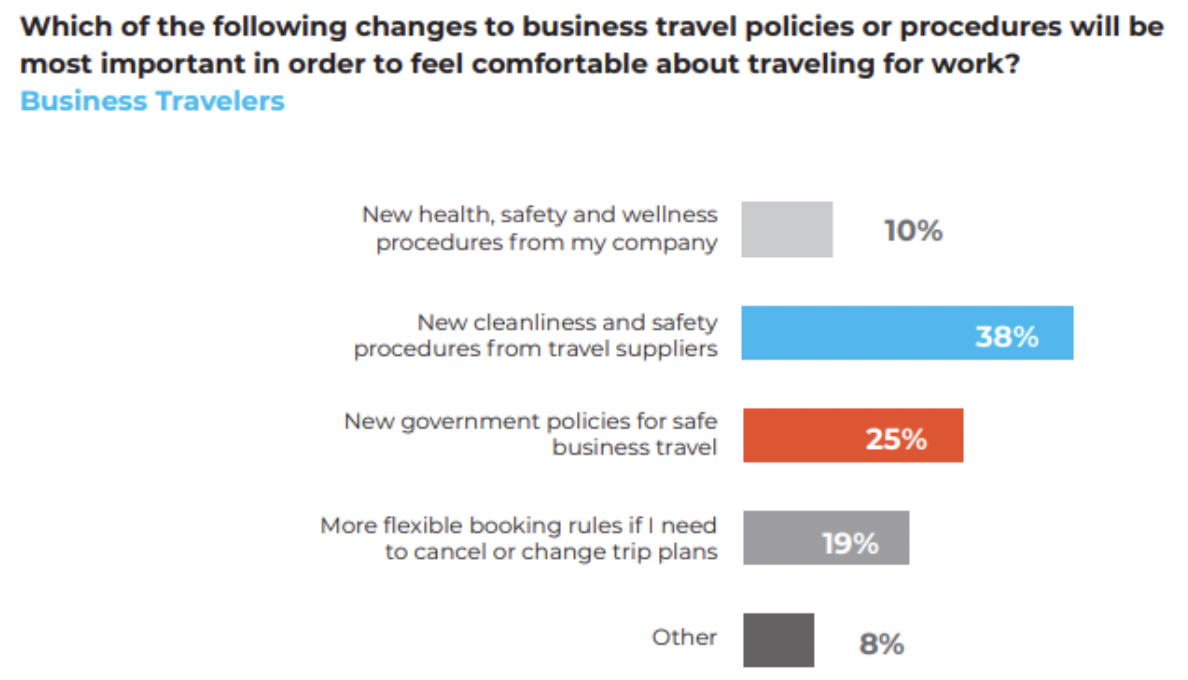

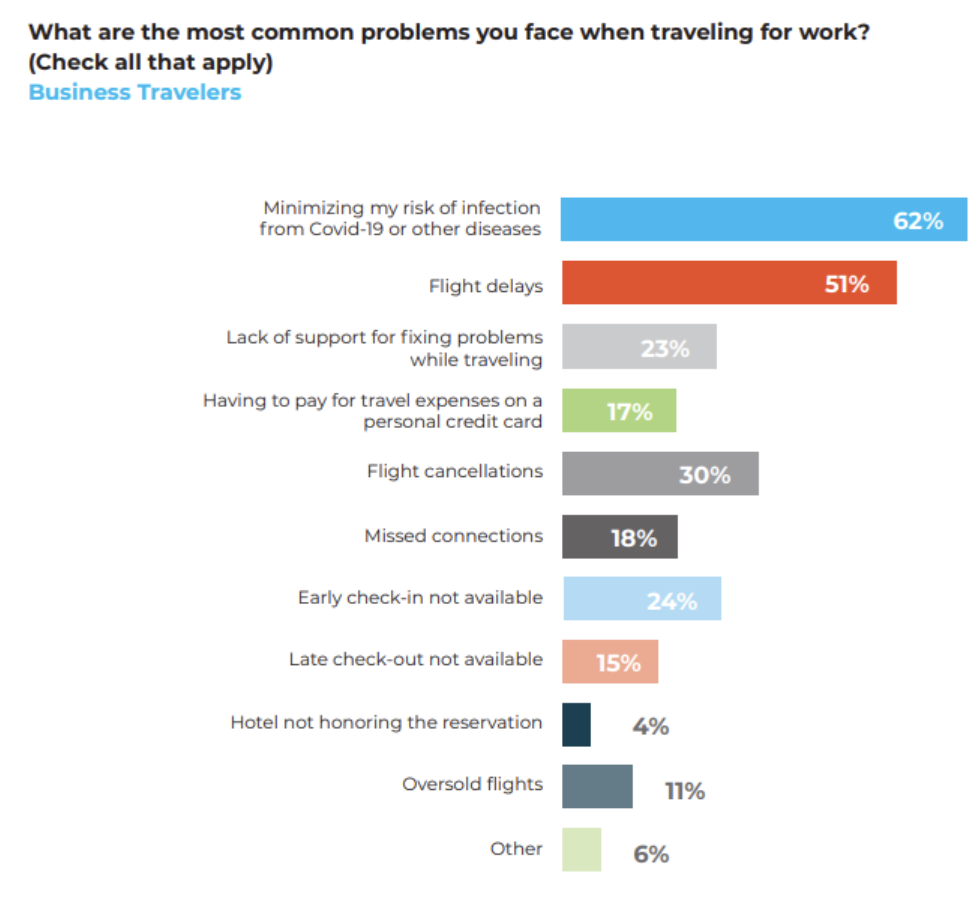

At a glance, they may seem like very broad asks for a very tall order. But when looking at the laundry list of problems business travelers are currently facing, it’s easy to see that everyone still wants the same thing they always did: safety and convenience.

Business travelers are concerned. Duty of care leaders have their work cut out for them.

There is no more status quo

While the jury’s still out on whether business travel bookings will ever return to their pre-pandemic peak levels, it’s safe to say that—at least for the near future—travel and expense management teams may still have some downtime to reflect, prepare, and plan ahead.

As the pandemic rages on and life boldly continues, we are all entering a new travel paradigm—one in which the central question will be: “Do I need to travel for this meeting?” Business travel and expense management will be less about getting people to meetings and more about the expected value of those meetings, which should always justify the costs.

With fewer but more strategic and flexible trips on the horizon, T&E spending solutions that feature flexible integrations with existing frameworks, robust travel management integrations, and automated, mobile expense reporting will fuel successful business travel in the 21st century.

Learn how Emburse Chrome River will make business travel easy and efficient and help prepare you for the post-pandemic world, today!

Missed Part 1? Read it now: The Future of Travel Part 1: Five Findings That Prove Business Travel is Here to Stay

Search

Subscribe

Latest Posts

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.