Carrier pigeons have long been used in human society. In ancient Rome, chariot races used carrier pigeons to inform owners how their entries performed. Across Asia and Eastern Europe, Genghis Khan established pigeon relay stations to send and receive messages across the Mongolian Empire.

Why did everyone rely on carrier pigeons back then? Because they were a fast, effective, and secure form of communication.

Obviously, carrier pigeons don’t have much use in today’s workplace. We graduated from snail mail to telephone calls to emails. More recently, we made the leap to mobile solutions.

Yet even with all this innovation, many companies don’t make use of the latest offerings. They still rely on email and outdated legacy technologies to communicate and collaborate. Often, they’re decades behind the curve.

If your organization still relies on email and phone calls to collaborate, budget, and manage expenses, you’re at a disadvantage. If you’re still taking on “tech debt” by relying on legacy solutions, you’re essentially digging a very deep hole that will cost a lot to get out of.

When it comes to spend management, staying ahead of the innovation curve by adopting the best technology solutions is mission critical. After all, spend management impacts cash flow, organizational efficiency, employee happiness, financial health, and much more.

Maybe it’s time to upgrade your tech stack to stay competitive with the times. Otherwise, you might as well use carrier pigeons, too.

You can’t fly when you’re carrying the weight of tech debt

Just as the carrier pigeon was a good way to send messages 1,000 years ago, popular expense management solutions that are still widely used today — like SAP Concur — were best-in-class expense management tools back when they came out in the ‘90s. But outdated expense management solutions only get more outdated with time.

Sure, they’re “updated” once in a while, but only piecemeal, so they end up accruing even more tech debt as the years go by. Eventually, all that tech debt balloons into a humongous deficit that can’t be paid down.

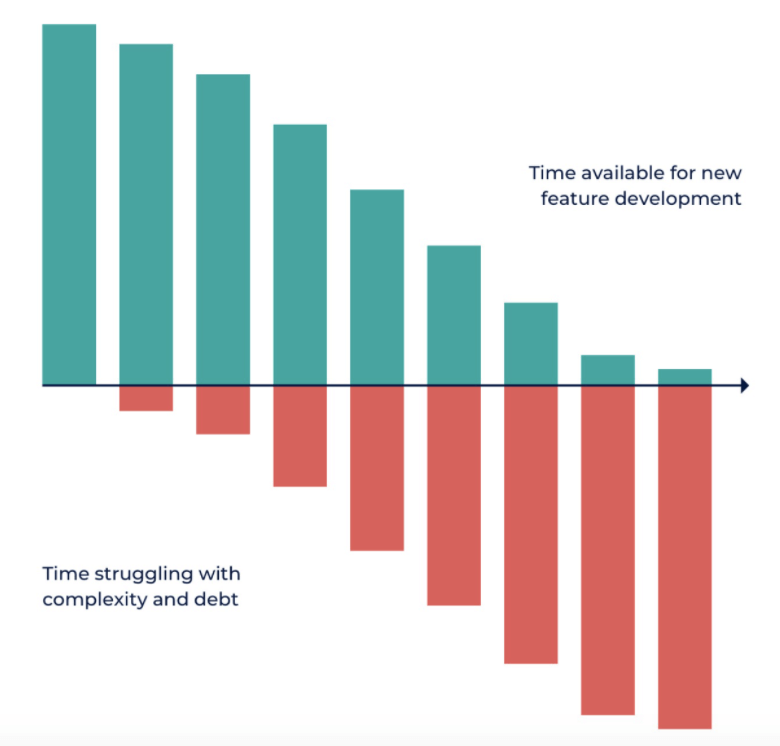

Source: As time passes, development teams have fewer resources to focus on new features. More resources are required to fix bugs and make repairs. Clients end up paying the price.

How big a problem is tech debt? A recent McKinsey CIO survey should alarm any decision-maker:

- CIOs state 10–20% of their technology budget for new products is diverted to fixing ‘tech debt’-related issues.

- CIOs estimate tech debt equals 20–40% of their total technology estate before depreciation.

- 60% of CIOs believe tech debt has risen a lot in the last decade.

Globally, Stripe estimates tech debt has a $3 trillion impact on GDP. Tech debt not only causes billions in lost productivity and wasted resources, but it can also lead to lost deals, higher employee turnover, customer churn, and even lawsuits.

For large enterprises, the dollar amount of tech debt easily enters into hundreds of millions or even billions of dollars. The prevailing “if it’s not broke, don’t fix it” mentality isn’t helping.

When it comes to expense management, kicking the ‘tech debt can’ down the road leads to countless headaches, especially when it comes to your ability to optimize spend.

You can’t optimize spend if you’re busy fixing spreadsheets

When you use old tech stacks for spend management, you don’t get a clear, unified view of overall spending. How could you? It’s basically impossible because you’re always playing catch-up with your spend data.

You’re left holding up your hands, asking “Where did I waste money last month? Where can I optimize spending? How much cash flow will I have next month? What will my profits look like?”

Without a clear picture of spending, the answer to every single one of those concerning questions is “I don’t know.”

Companies that continue to rely on outdated expense management solutions face the following disadvantages:

- Spend data is often stored across multiple systems, which leads to a lack of transparency and results in siloed operations without a single source of truth.

- Manual expense reporting remains costly, time-consuming, and mistake-prone (e.g., keystroke errors). It also leaves organizations wide open to financial fraud.

These deficiencies mean there’s no reliable way to distill financial information into actionable insights. Finance and accounts payable teams can’t optimize spending when they don’t know the who, what, where, when, why, or how of their spending.

Given that only 46% of enterprises have a dedicated expense management solution, it’s no wonder the top five pain points for travel and expense management teams stem from not having a unified platform:

Source: You can’t improve what you can’t track! And you can’t optimize expenses if you manually reconcile data, review reports, hunt down receipts, clean up spreadsheets, etc.

Your organization’s expense management tool impacts your bottom line. But if you’re using an outdated solution built on old technology, you won’t achieve the full potential of your spend management.

That’s why you need an agile cloud-based solution. Modern expense management solutions not only empower you to unify your data, but they also help you uncover key trends so that you can identify real-time opportunities hiding in plain sight.

Flying away from the “If it ain’t broke” mentality

Most organizations do understand the value of modernizing legacy systems. A global CFO survey revealed that 94% of finance execs prioritize digital transformation investments. Technology investments like modern spend management platforms are seen as key to the survival of any business.

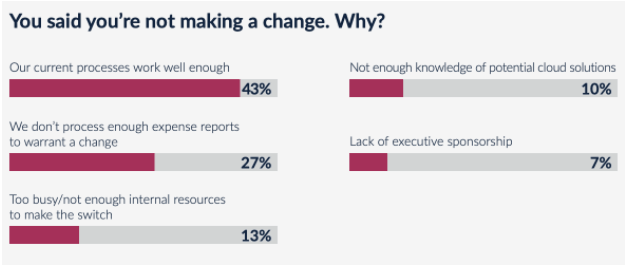

Of course, knowing something and acting on it are two different things. Unfortunately, the same CFOs admit that they haven’t upgraded their spend stack because old solutions “work well enough” or because they’re literally “too busy...to make the switch”:

Many decision-makers agree that digital transformation is important. But that doesn’t mean they necessarily want to make a change. Many aren’t convinced they need to take action yet.

But maybe they’d change their minds if they considered the following stats:

- Tech debt creates more manual labor and makes it difficult to automate tasks that can be automated. For instance, manually processing an expense report costs $26, versus $7 per automated report.

- Using outdated software costs large enterprises $425,000 more on average than adopting an innovative modern solution.

- Engineers spend 33% of their work hours dealing with technical debt. When the average software engineer makes $108,249 a year across the U.S., that’s nearly $36,000 wasted per engineer.

It’s important for financial decision-makers to recognize tech debt for what it is: a costly business expense that negatively impacts your bottom line (and one that carries interest). From there, you should analyze how big your tech debt is and which areas require immediate attention. Then, you can begin to lay out a framework for tackling tech debt effectively.

Finance teams deserve better

Modern finance, expense management, and AP teams deserve a unified, transparent, and customizable solution that will help them optimize spending and improve cash flow and profitability.

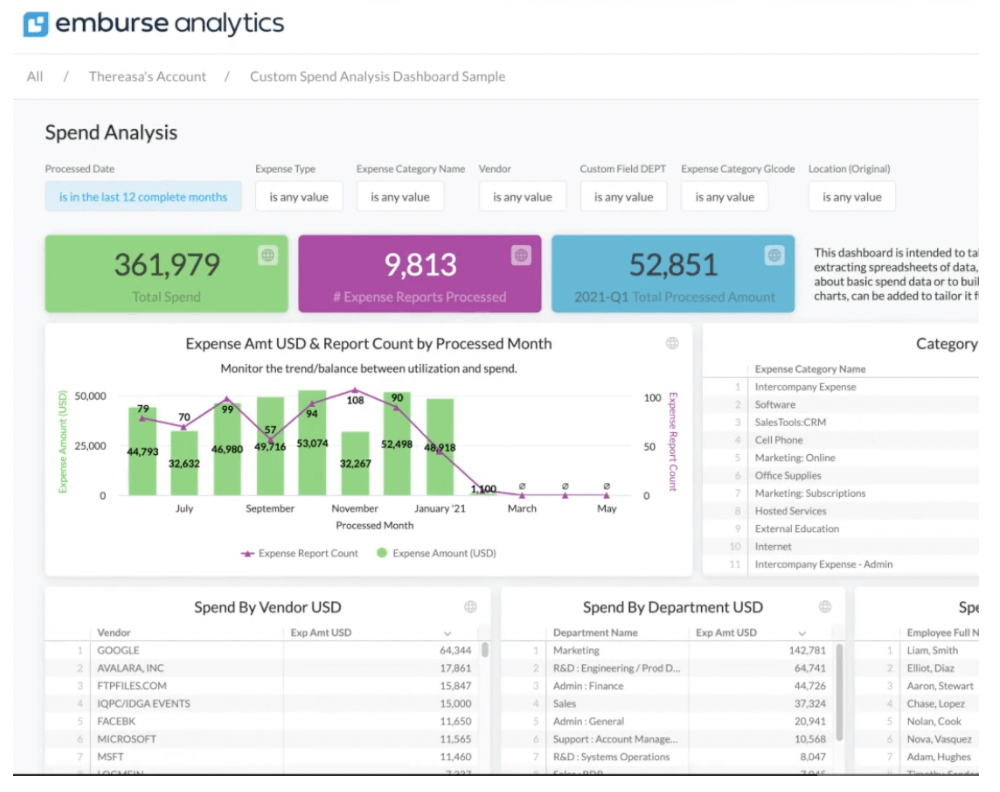

Source: Modern expense management solutions are transparent and agile. Configure them to automatically enforce compliance rules, spot trends, extract insights, and unlock opportunities.

When you have an agile cloud-based solution that can evolve with your business, you’ll always have access to the most recent data and the most accurate insights you need to negotiate better terms with vendors, improve accountability and compliance, forecast cash flows more accurately, and stay within budget more easily.

Perhaps most importantly, you’ll humanize work for your team. By letting finance teams focus on high-value activities rather than repetitive tasks that can and should be automated, you’ll contribute to higher employee satisfaction and retention.

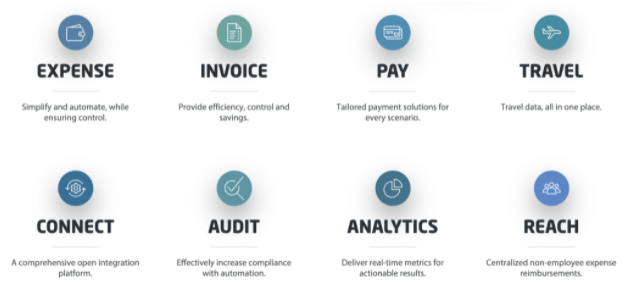

Agile, cloud-based expense management solutions like Emburse Chrome River offer a seamlessly integrated, fully supported suite of customizable tools. Built with future-ready technology, Chrome River is designed to evolve with your organization.

Every feature, from expense and invoice processing to analytics and auditing, are designed to maximize team efficiency and optimize spending. This way, your team can always stay one step ahead of the curve, instead of waiting on updates that never arrive or dealing with clunky, unwieldy features.

Here’s another statistic: 88% of clients that made the switch from SAP Concur to Emburse Chrome River saw a return on investment within one year. If you’d like to see how Chrome River can help you fly ahead in the 21st century, contact us today:

Search

Subscribe

Latest Posts

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.