While not all bottlenecks can be easily circumvented, identifying where things are getting stuck or slowing down is the first and most important step towards eliminating the problem. This is true of every department but is especially relevant for accounts payable (AP) teams.

Here are four common bottlenecks AP teams encounter:

- Time-consuming manual tasks

- Changing work landscapes

- Approval and processing delays

- Administrative costs and fraud

The good news? These can be overcome through better AP automation solutions and modernizing your AP workflows. Let’s take a closer look into the challenges facing enterprise and corporate AP teams today:

Challenge #1:Time-consuming manual tasks

We all know the expression “there are only so many hours in a day.” However, when delving into accounts payable, you need to figure out how much time your team spends on laborious processes that can and should be simplified.

Put another way, “there are only so many productive hours in a workday.”

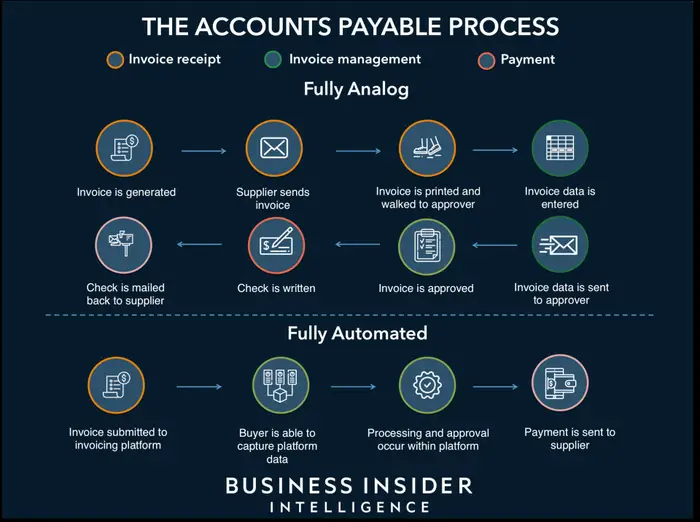

From beginning to end, the typical AP workflow for companies of any size may include a minimum of five steps and require multiple approvals, all before a single check goes out to a vendor. A typical AP process often looks something like this:

- Receive vendor invoices.

- Perform a 3-way match for consistency.

- Consult on discrepancies with the buyer.

- Resolve flagged issues.

- Verify receipt of goods and services.

- Receive AP department approval for invoice payment.

- Submit checks and payments.

- Mark invoices as paid.

A lot goes into each of these steps—and a lot can get in the way. Competing priorities, bureaucratic issues, and human error can slow down this already glacial process, resulting in countless wasted hours (if not days and weeks).

Analog vs. automated accounts payable

No matter the size of your business, your accounts payable (AP) process is an intricate and essential part of operations. But all too often, companies don’t prioritize streamlining their AP operations. Failing to do so limits employee productivity that could be better spent on more strategic work, not on:

- Manually adding data and invoices to Excel spreadsheets

- Manually integrating data with an existing ERP, like Netsuite, Oracle, SAP and others

- Creating and approving requisitions

- Hand-delivering invoices to desks, or attaching to emails for approvals

- Matching invoices by line items

- Matching and processing payments

- Writing out and sending paper checks

- Responding to long email threads for non-compliant submissions

According to a MineralTree survey, “non-modern teams who used manual AP processes reported spending nearly three times the amount of time processing invoices than modern teams benefitting from more automated AP, on average.”

Challenge #2: Changing work landscapes

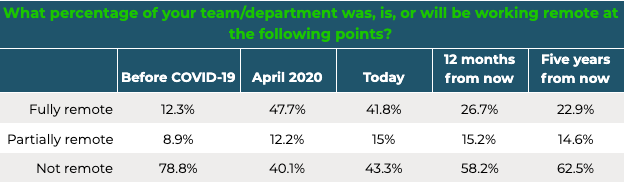

The business landscape will never stop evolving. Automation is at the core of this, just as it has been since the Industrial Revolution. Nowadays, we’re seeing an increasing number of employers offering full-time or part-time remote work—and it doesn’t look to be going away any time soon. In fact, a recent report released by Upwork found that 36.2 million (22%) Americans will be working remotely by 2025.

“...the outlook for remote work remains strong…”

As optimistic as these numbers seem, remote and hybrid work come with unique challenges for employers. Multi-step manual processes and outdated software solutions become increasingly difficult to manage and even more frustrating when employees work from home.

It’s hard to complete AP tasks in an accurate or timely manner when your team relies on paper requisitions, paper invoices, paper checks, etc. Of course, these inconveniences don’t only affect remote workers. Traveling employees also experience challenges with manual submissions and approvals.

Challenge #3: Approval and processing delays

When your AP process is inefficient, it not only impacts all levels within your organization, but outside stakeholders can also feel it. Delays in payments due to drawn-out processes negatively impact your supplier and vendor relationships.

According to a study by Ardent Partners, it takes nearly 10 days just to process a single invoice. If the statement “we still haven’t received payment yet for the services or goods we provided” sounds all too familiar, then your AP process takes far too long.

Besides putting a strain on your vendor relationships, payment delays make keeping accurate inventories, linking invoices to purchase orders, and delivering strategic insights very difficult.

Outdated AP processing workflows are further complicated by human error. Whenever a mistake is made, AP teams end up wasting valuable time pinpointing and correcting errors—time that’s better suited for strategic and creative decision-making.

Challenge #4: Administrative costs and fraud

Slow and inefficient AP processes can hurt your bottom line in more ways than one. Incidental expenses that might seem minuscule quickly add up, such as check mailing and printing costs. Delayed approval and invoice processing can often lead to overpayments, late payments, late fees, and interest charges.

A cumbersome process also makes it difficult for any company to be eligible for early payment discounts, preventing them from adequately recognizing seasonal supply trends or vendor pricing increases.

Aside from that, older AP solutions can cost you up to $10 per invoice. As your business continues to grow, so will the demands upon your team. To keep up with increasing invoices and approvals, additional staff will have to be hired, resulting in higher operational costs overall.

As if operational costs weren’t enough of a reason to re-evaluate your company’s legacy AP processes, not upgrading also carries a much higher risk of fraud. A lack of regular updates means fewer cybersecurity best practices, less insight and visibility into real-time spending, and missing compliance controls that could make your AP department much more vulnerable to fraudulent charges and transactions.

Here’s one example: the City of Albuquerque’s accounts payable team fell victim to fraud and was almost scammed out of $1.9 million. Unfortunately, this happens all the time. A recent survey by PwC found that out of 5,000 respondents, 47% of companies experienced fraud in the past 24 months.

Driving AP success with automation

Doing more with fewer resources is becoming the norm for modern organizations. Fortunately, by identifying your company’s AP bottlenecks and challenges, you have the opportunity to identify and upgrade to more affordable solutions that can save your team countless hours and resources, making a real difference on your bottom line.

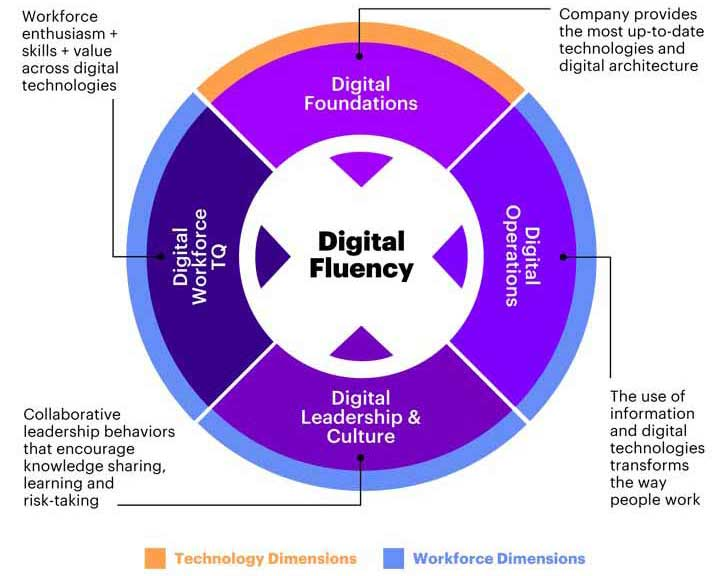

In a recent study, Accenture found that only 14% of companies are considered digitally mature. As our markets evolve, these companies give their employees the proper tools, training, and procedures to succeed in a fast-paced, rapidly growing tech ecosystem.

“Organizations that are most digitally fluent can capture strong returns…”

As we grapple with our “new normal” and the ever-changing business landscape, there is no better time to re-evaluate our reliance on antiquated AP Management processes and look towards the future of modern AP teams.

Emburse Chrome River helps companies modernize their AP processes by offering automated expense management and accounts payable solutions that weren’t built in the 90s. Empower your employees and increase productivity at all levels within your organization by eliminating all those tedious, time-consuming manual tasks that just end up being risk vectors anyway.

Search

Subscribe

Latest Posts

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.