The past two years have not been easy on most businesses. From the coronavirus pandemic to unexpected natural disasters, companies were impacted in countless unforeseen ways. Now, more than ever, collaboration, cooperation, and consensus within executive leadership teams are essential to continued growth and success.

Why? Because when business climates change this quickly, trust is priceless.

According to Accenture, 54% of companies lost revenue in 2020 due to a lack of trust between leaders and their teams. The collective revenue loss for companies on the Accenture Strategy Competitive Agility Index exceeded $180 billion.

Finance and Procurement—departments that used to operate on a mostly independent basis—are rising to the challenge and finding new ways to work together and build back that trust to drive better outcomes.

Here are five reasons why Finance and Procurement work better together.

1. Business and tech decisions shouldn’t be made in a vacuum

In the 21st century, technology is money. And since the pandemic, new and improved hardware and software solutions have become cornerstones for every growing business. Upgraded technology stacks cost a lot of money, so Finance had no choice but to become even more of a strategic decision-maker.

In fact, 72% of CFOs surveyed by Accenture report that they now have the final say on technology investments and future tech direction at their companies. This makes a lot of sense—up to 60% of traditional finance tasks are now automated (up from 34% in 2018). Predictive analytics and financial modeling solutions offer real-time data insights, enhanced forecasting, and more accurate scenario analysis.

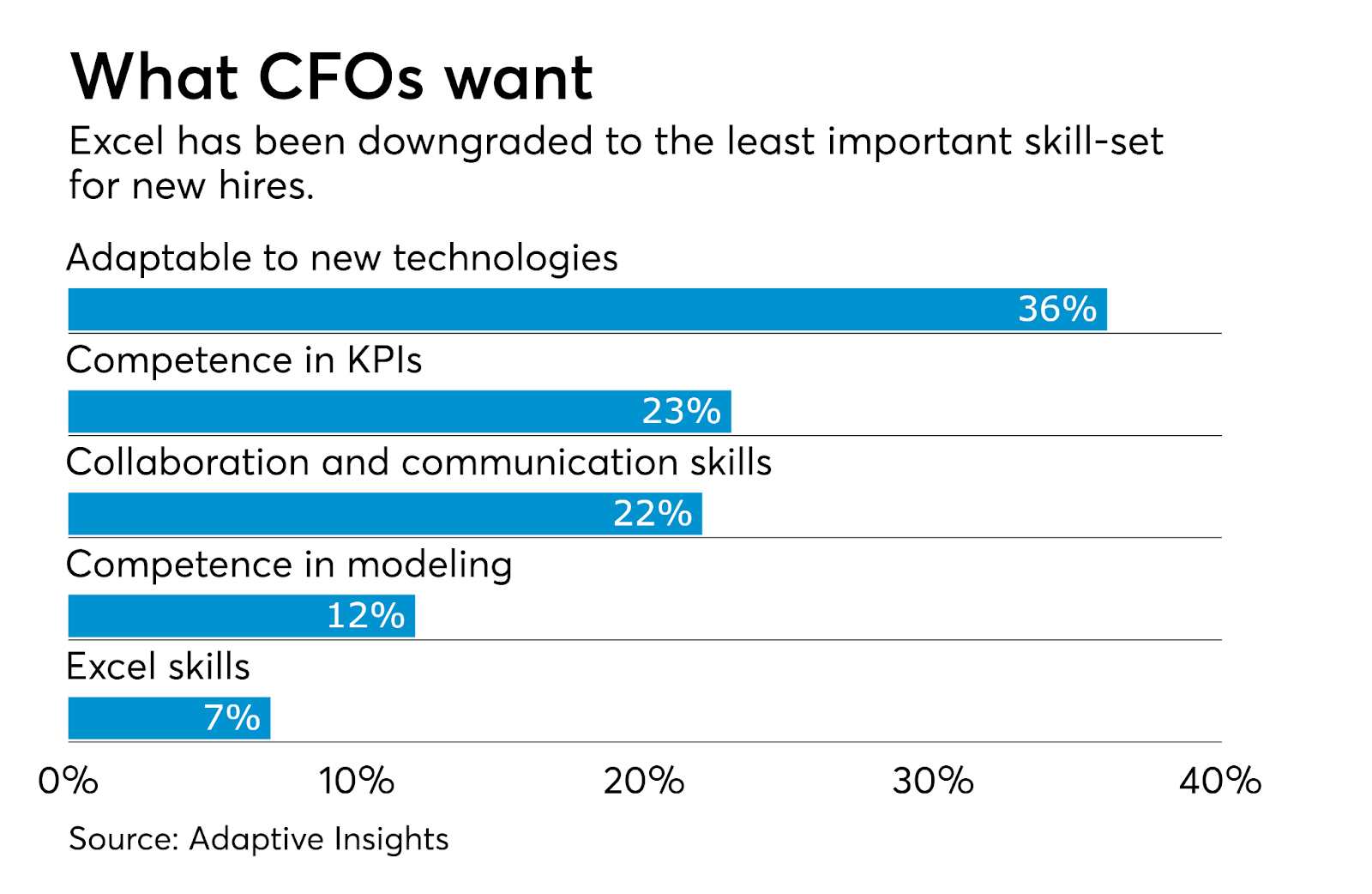

As many as 77% of companies believe CFOs should work with other company leaders to achieve shared goals. Unsurprisingly, 86% of CFOs regularly collaborate with other C-suite partners like CTOs, CMOs, and CPOs. Yet only 7% of CPOs and procurement leaders believe technology collaboration is currently happening in their companies.

This massive discrepancy in perceived technology collaboration tells us that many procurement teams have been left out of the conversation. It’s the 21st century, yet they’re still expected to go out there, “trust their gut,” and make critically important business decisions with little support (and lean budgets).

This disconnect between business and technology leaders is a missed opportunity and a critical error. Procurement teams should be encouraged to work closely with other teams (namely, Finance) to ensure that they are making the best possible investment decisions.

2. Procure-to-pay (P2P) decisions should be made jointly

Finance teams and procurement are both faced with far higher expectations going forward. While leadership in both teams still has a unique role to fill, they have compelling reasons to become natural allies. One example of a procurement function that increasingly involves Finance is procure-to-pay (P2P) solutions.

P2P operations are fully integrated solutions that support end-to-end procurement, from goods and services requisitioning to accounts payable. P2P decisions are quickly becoming a significant Finance responsibility. A working relationship with Procurement is critical for Finance to learn the ins and outs of successful P2P operations.

When Finance and Procurement make P2P decisions together, companies reap the rewards. According to Accenture, when finance, supply chain, and procurement teams are unified, companies see:

- 15–20% sourcing savings across direct and indirect spend

- 15% or more saved on Selling, General and Administrative Expense (SG&A)

- 3–5% lower Cost of Goods Sold (COGS)

- 0.5–3% increase in spend optimization

3. Company spending can and should be better managed

The pandemic exposed how countless companies were mismanaging (or simply not analyzing) their spending. For example, very few organizations were paying attention to their supply chains. Regular, everyday items started going out of stock worldwide in the blink of an eye.

How did this happen? Companies scrambled to pick up the pieces of the supply chain (read: overspend) as factories shut down due to social distancing measures. Finance and procurement teams that weren’t in the habit of communicating had no chance of surviving the black swan event.

Deloitte’s 2020 Chief Procurement Officer Flash Survey revealed that 90% of organizations rate their supply chain visibility as “moderate” to “very low.” That’s why 64% of Procurement teams now focus less on supply continuity and more on rethinking how supply chains should work in a post-pandemic world.

Forward-thinking Procurement leaders should focus on better decision-making through the lens of better managing company spend as the economy recovers from the pandemic. Strained revenues are forcing procurement teams to understand how costs and capital commitments impact company cash flows.

Of course, there’s no function better suited to guide Procurement on this journey than Finance.

4. Siloed decisions don’t lead to good risk management

Of course, 21st-century supply chain problems are just one example of mismanaged spending. They also point to a deeper problem: a lack of proper oversight into siloed decision-making.

For example, many CPOs knew the cost of goods sold and how quickly they were moving inventory. But they were hazy on the details of where they were sourcing those goods, what vulnerabilities they were exposed to, and what contingency plans (if any) they had in place.

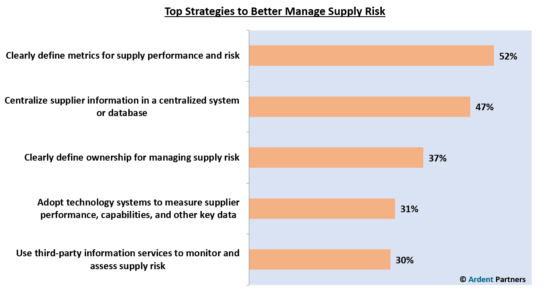

Despite this unprecedented level of supply chain risk, a study by Ardent Partners found that:

- 79% of companies lack a comprehensive risk-management plan for strategic suppliers.

- 69% of companies lack an active supply risk-management plan, period.

- A small handful—9% of companies—are prioritizing improved risk management.

Procurement has never been as involved with other business functions as it is today. At the same time, Finance has no choice but to dive headfirst into business areas they aren’t as familiar with. The only way to properly manage the complex risks inherent to 21st century supply chains is to bring their unique perspectives and insights together.

5. Without consensus, there can be no trust

The only way to achieve consensus is to give business leaders the same data, ensure they can access the same insights and perspectives, and then empower them to decide how to move forward as one company. It’s the only real way to build a lasting culture of trust and cooperation, but it requires aligning teams across functions.

Unsurprisingly, 76% of CFOs surveyed by Accenture believe there needs to be “one version of the truth” for their business—a single, unifying mission. Without shared goals and mutual understanding, any organization will have a hard time meeting its objectives when the world remains so uncertain.

Fortunately, 34% of CPOs surveyed by Ardent agree that their number one priority is to automate and digitally transform the procurement department.

Leaders work better together

Today’s Procurement and Finance leaders find themselves in a unique position within their organizations. They have more online collaboration tools and shared data at their fingertips than ever before, which should make it easier to work together.

But more often than not, teams work to the beat of their own drums rather than in harmony. The pandemic revealed just how flawed this type of siloed thinking could be, exposing how it hinders progress and leaves companies vulnerable to multiple points of failure.

Procurement and Finance are poised to enter a more prosperous future—but only if they learn to work better together.

Download the Report: 5 Reasons Why CPOs & CFOs Work Better Together

Search

Subscribe

Latest Posts

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.