As previous posts in this series (8 Ways Companies Can Adapt to The New Financial Landscape, Is Now The Right Time to Revisit Your Solution?) have indicated, the reality of corporate travel and expenses has changed drastically due to the ongoing COVID-19 pandemic. Yet despite this worldwide travel upheaval, companies are slowly but surely resuming business travel, while supporting new, remote work options

But while many of us can’t wait for things to go back to normal, the question remains: do we really want to go back to how we used to do expense management?

Although corporate trips remain around 70% below pre-pandemic levels, this lull is temporary. Demand for business travel is on the rise. Eliminating outdated and inefficient processes and upgrading tired T&E systems while business travel is still recovering can save organizations time, money, and manpower.

Rather than having multiple departments chasing, looking over, and approving receipts manually, for example, switching to a more modern method streamlines the entire reconciliation process. This, in turn, reduces the chance of human error and fraud.

How should organizations move confidently into this new era of T&E management? Here are four important questions to ask yourself:

1. How old is my current T&E management system?

Given recent technological advances, it seems unlikely that profitable companies would continue to rely on manual processes to handle million- or billion-dollar expense accounts. Yet this is the reality for many businesses—even at the corporate and enterprise level.

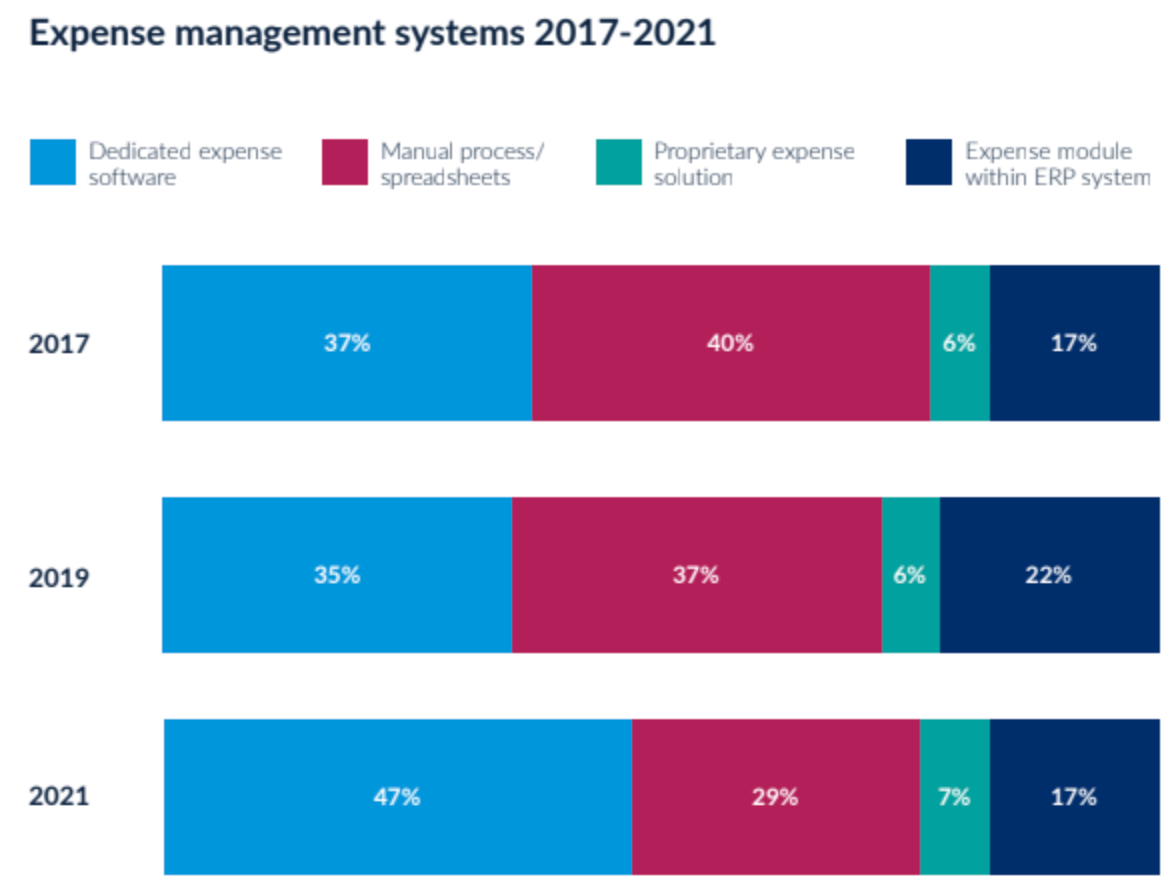

Sure, legacy expense management solutions, which include everything from pen-and-paper bookkeeping to Excel spreadsheets, have become less popular over the past few decades.

But as of 2021, an astonishing 29% of organizations still rely on outdated expense management and AP systems for all payments, while 52% of organizations still rely on them for all non-employee expenses.

Not only do these processes require additional human resources—which cost a lot of time and money—but they also leave considerable room for easily preventable human errors. T&E managers often waste countless hours chasing down and verifying receipts (or just double-checking their spreadsheets).

Meanwhile, processing times for expense reports can take anywhere between 8–30 days for most organizations. This doesn’t include the substantial margin of error that comes with manual processes, which translates into more unnecessary expenses for your company.

Clearly, legacy T&E technology is costly, inefficient, and outdated—but still surprisingly popular.

2. Why haven’t we upgraded to a better solution yet?

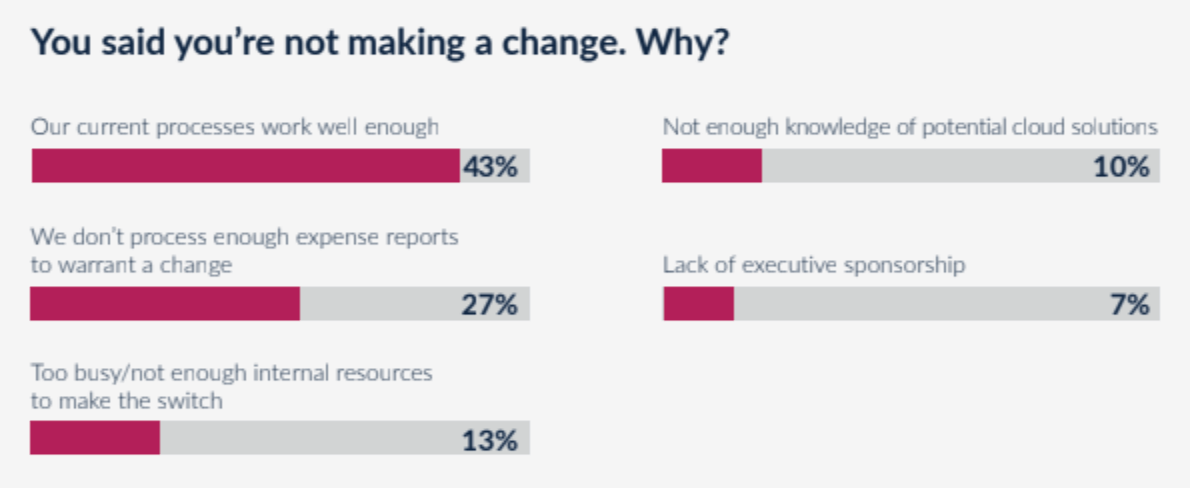

Profitable enterprise companies may be unwilling to upgrade to more modern systems for any number of reasons, including a lack of internal resources or little-to-no familiarity with potential alternatives. But that can be easily remedied.

The greatest obstacle to change? Inertia. According to the Emburse 2021 Travel & Expense Management Trends report:

- 43% of organizations have no plans to automate current expense management systems and insist their current legacy systems are fine.

- 78% of companies with over 10,001 employees, and 54% with 501–1,000 employees, feel similarly.

- These organizations, which pay out millions to billions of dollars annually, believe their current systems are sufficient and they do not need cloud-based alternatives.

It’s a classic case of familiarity bias, and it’s costing companies more than they know. Just because a solution has worked well in the past doesn’t mean it’s the best tool for the job today.

3. Do decision-makers see the need for digital transformation?

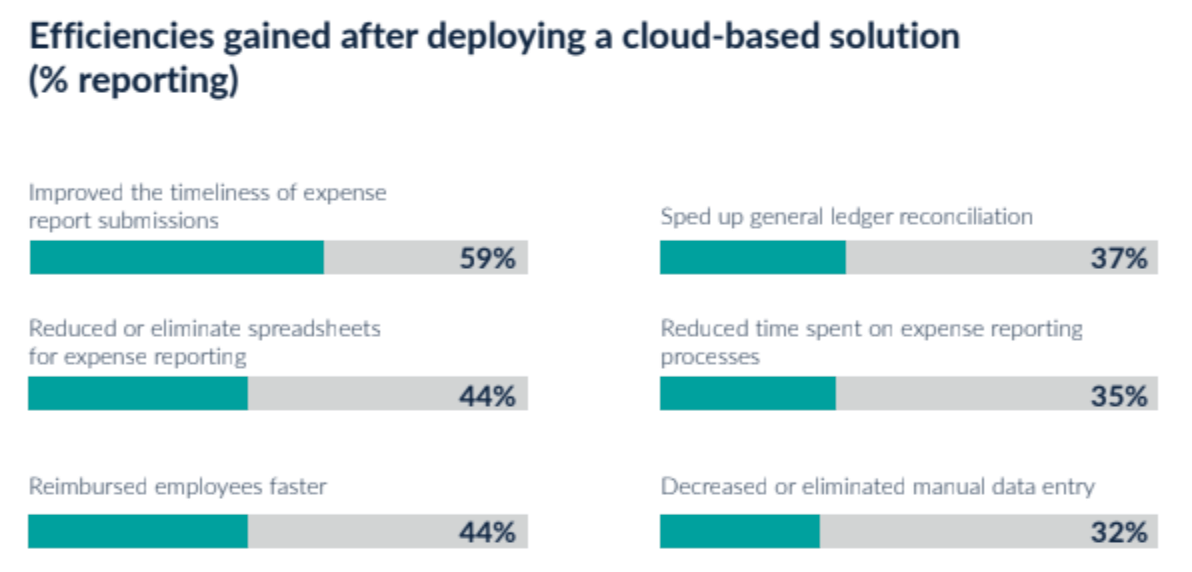

A staggering 94% of CFOs say that digital transformation is critical to an organization’s future success. This includes migrating from legacy technology to an integrated, automated, cloud-based solution. It should come as no surprise that users of integrated expense management solutions are more satisfied at work.

An integrated T&E management solution eliminates the need for spreadsheets and manual data entry, and greatly improves turnaround times for everything from expense reports to presentations. As many as 81% of organizations utilizing cloud-based expense management systems report simplified expense reporting.

Centralized, cloud-based systems also offer both employees and managers more transparency, which leads to faster reimbursements, reconciliations, and payments. Connecting a dedicated expense solution with a credit card feed or accounts payable system improves operational efficiencies across the board and reduces the chance of human errors.

Worried about the cost? Don’t be. Investing in a modern T&E management solution results in both near- and long-term ROI, with 27% of organizations noting that they recouped their investment within six months of implementation.

4. When’s the last time we looked at our spend policies?

A modern, integrated solution can also help enforce company T&E policies. While more than 78% of organizations have a formal travel and expenses policy in place, almost 42% admit theirs needs work.

Meanwhile, travelers are often uncertain or unaware of the details of their company’s policy, including what is or isn’t allowed. In fact, 27% of organizations surveyed said that of the expense reports they receive, only 75% are compliant.

An easily configurable, rules-based cloud solution can lead to improved policy compliance and violation monitoring at all levels of an organization. It can encourage employees to be more accountable for their spending and alert them when they’re not (no direct supervisory intervention required).

There’s an added benefit to this type of automation: it can also improve employee-supervisor relations, as it turns policy violation issues from personal infractions into learning experiences that can result in valuable system updates.

Instead of dressing down an employee behind closed doors, for example, T&E managers can let the system do the talking for them (which is more impersonal/less likely to offend or embarrass someone). Instead, they can choose when to use a violation as a confidential case study to educate employees on policy-friendly spending practices.

5. Is it time to move forward?

The most important thing to keep in mind is that a T&E management solution should work for you. It should help save your organization time, money, and human resources. You shouldn’t be spending more time and money to upkeep or maintain it. You certainly shouldn’t have to jump through endless hoops just to use it.

Don’t settle for solutions that fail to meet your criteria. Dissatisfactory pricing models, problematic terms and conditions, outdated user interfaces and experiences, inadequate analytics and reporting features, and poor customer service and support are just some of the many reasons your T&E management system may be overdue for an upgrade.

In the fast-paced, ever-changing business environment we live in today, it pays to stay ahead of the curve. Modern T&E management solutions should accommodate a growing remote workforce, as-needed business travel, and increasing digitization in all aspects of life.

Is your T&E management solution doing your business justice? If not, maybe it’s time it did.

Search

Subscribe

Latest Posts

- Driving AP Success With Automation Part 3: How to Save Time and Money While Increasing Compliance

- Driving AP Success With Automation Part 2: How to Create More Efficient Processes With AP Automation

- VAT IT Partners With Emburse to Help Companies Save 27% on Expenses

- Driving Success With Automation Part 1: 4 Common AP Management Bottlenecks

- The Future of Finance: 5 Predictions For Digital Transformation in 2022 And Beyond

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.