To say that the pandemic shook up Finance in a big way would be an understatement. The past couple of years completely changed how Finance teams work and think about work.

The craziest part? We haven’t seen anything yet. Over the next 5–10 years, the breakneck pace of transformation within the Finance function will be unlike anything we’ve ever seen. In 2022 and beyond, the future of Finance has never been brighter. The work we do, how we do it, and how it impacts our organizations is up for grabs.

No one has all the answers yet. But we have a pretty good idea of where things are going, and how to best prepare for what’s coming.

The State of Finance in 2022

Here’s the good news—we can already see some of this coming sea change and learn from what’s happening. The technologies that will reimagine and reinvent Finance are being implemented at forward-thinking enterprises worldwide.

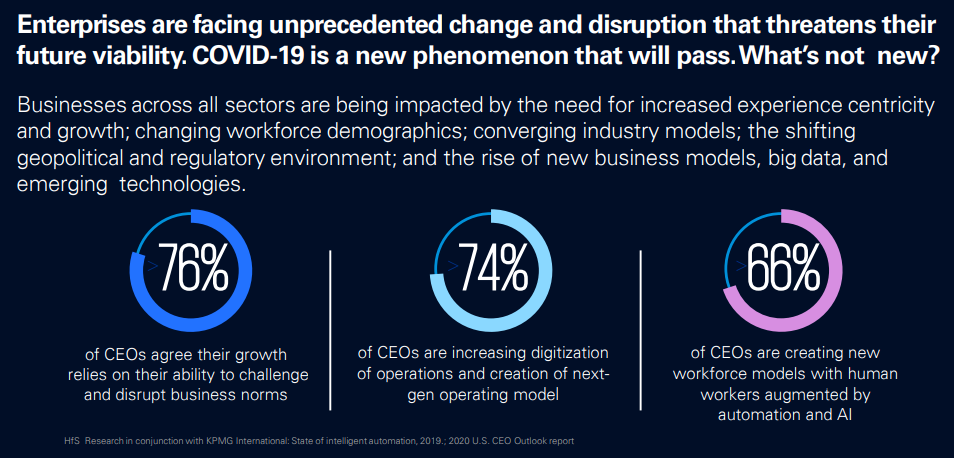

Source: The Future of Finance (KPMG Advisory)

Unfortunately, not all Finance leaders are ready to upgrade their financial systems or expense management solutions. In a recent study, Accenture found that only 14% of companies are digitally mature enough to compete in the fast-paced and rapidly growing financial technology and services ecosystem.

Fortunately, Finance leaders aspiring to digitally transform their departments don’t need to reinvent the wheel. Modern use cases give us a pretty good glimpse at the near future. The lessons are already out there, but it’s up to forward-thinking Finance leaders to adapt to this brave new world and adopt the right solutions for their organizations.

Here are five predictions for how Finance will continue to evolve in 2022 and beyond, and what we think about each one of them.

1. Data-driven decision-making unlocks business value

Did you know that nearly 88% of Finance professionals believe better data and more reliable business intelligence are key pieces of the AP puzzle? According to a Deloitte survey of 784 global Finance leaders, 40% of respondents planned to implement or were in the process of onboarding advanced data analytics.

Yet only 10.1% of Finance leaders had already implemented a solution. Few organizations are able to properly aggregate, align, or integrate their data—which means they aren’t able to capture the full value of digital transformation.

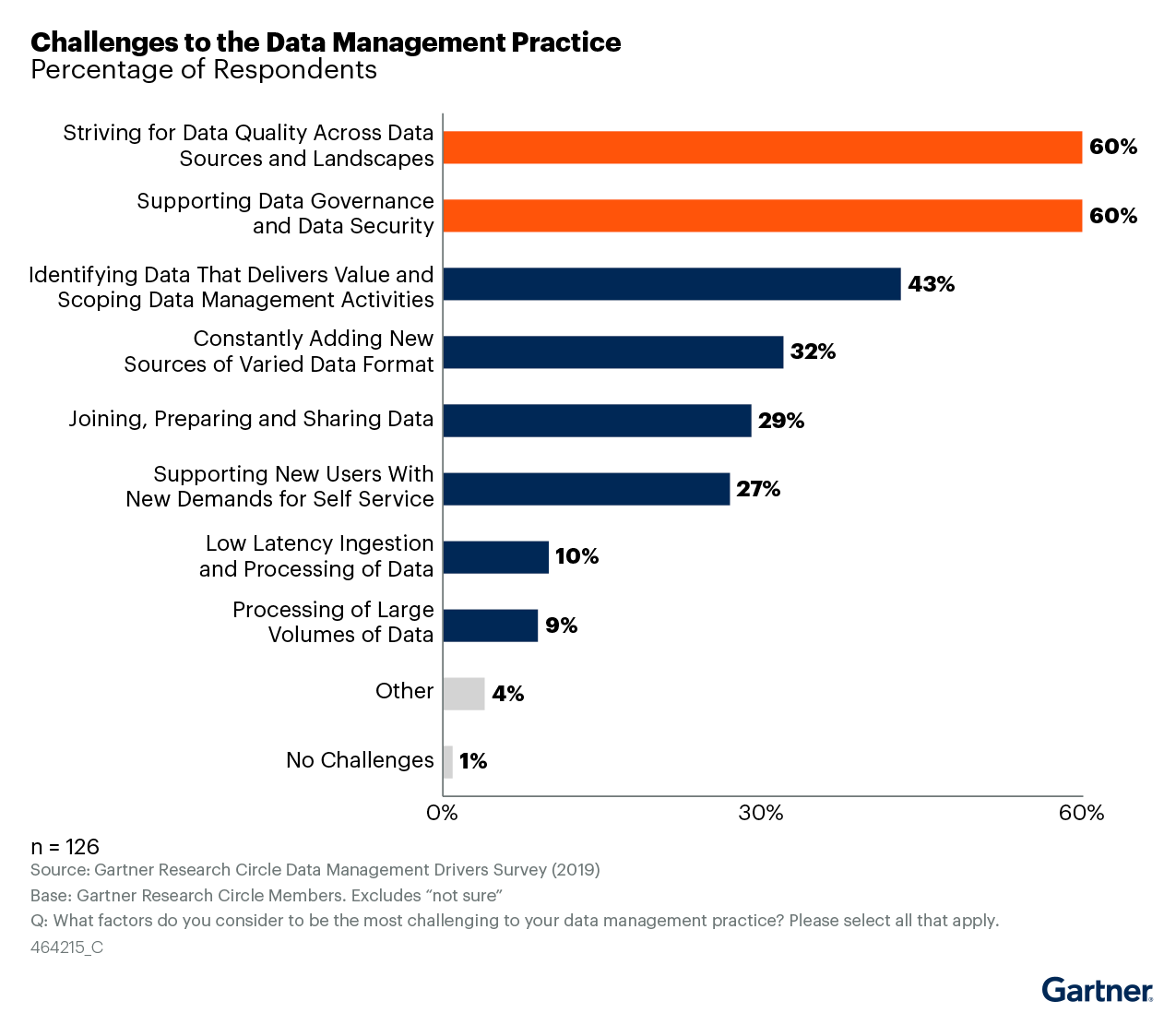

In a recent Gartner survey, financial decision-makers revealed their most concerning data aggregation, adoption, and analysis challenges:

- Striving for data quality across data sources and landscapes (60% of respondents)

- Supporting data governance and data security (60%)

- Identifying data that delivers value and scoping data management activities (43%)

Source: Gartner Research Circle Data Management Drivers Survey

Source: Gartner Research Circle Data Management Drivers Survey

Unfortunately, these challenges may as well be aspirational goals for companies that are still bogged down by the financial equivalent of backbreaking manual labor. Nearly 76% of respondents to Deloitte’s survey admitted their company’s accounting processes were still “a considerable manual effort” or “largely manual” (i.e., less than 50% automated).

In other words, many Finance teams simply don’t have the time to properly analyze their data or glean insights that could inform better business outcomes, which means they’re unable to optimize for cost and time savings.

They’re also paying a hefty price for continued inaction. Gartner found that organizations waste $12.8 million per year by not switching to automated Finance and expense management systems.

The bottom line: The importance of clean, high-quality data cannot be understated, especially for companies that want to optimize operations and spending. Finance teams simply cannot rely on siloed, lagging financial data to make consequential decisions. When data is auto-aggregated and screened, Finance teams can focus on confidently analyzing spend data, discovering actionable insights and enhancing day-to-day decision-making to drive better business outcomes.

2. Finance apps and microservices will become more attractive

Traditional enterprise resource planning (ERP) platforms are losing favor with every passing year. As departments become more specialized and financial roles continue to evolve, specialist tools and dedicated solutions have emerged that will only continue to grow in popularity. Since enterprise automation is becoming more commonplace, optimization is the name of the game.

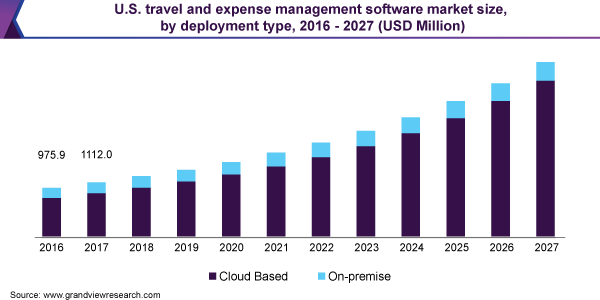

Source: Grand View Research

At the same time, new ERP entrants boast specialized apps and microservices that can easily integrate with older ERP platforms. Cloud-based expense management, for example, can play nice with existing frameworks to ensure that Finance teams feel comfortable adopting new spend solutions.

As cloud integrations and applications become the norm, the end-user is the ultimate winner. Unwieldy workflows will make way for streamlined microservices, while convoluted, legacy technology stacks will be replaced by more accessible and automated digital solutions.

According to Business Insider, companies that adopt automated expense management solutions report 81% lower processing costs and 73% faster turnaround times. Not to mention that 78% of Emburse customers that implemented expense automation solutions saw ROI in the form of increased employee productivity in under 6 months.

The bottom line: This isn’t so much a prediction as something that’s already happening. The trend away from out-of-the-box ERPs like SAP Concur towards customizable, specialized finance apps and microservices that can be integrated with existing systems is well underway (Emburse is one of them). Companies don’t want to be forced to learn clunky, nonintuitive ERPs—they want to do spend management their way.

3. Optimization leads to more time for innovation

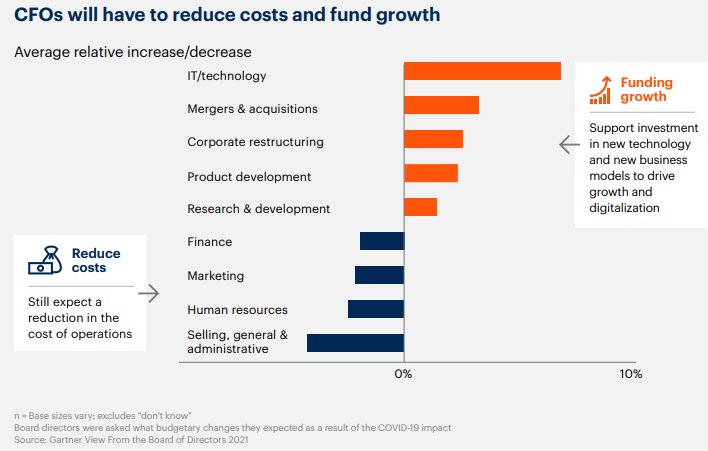

A 2021 Gartner survey of global CFOs revealed that Finance teams are planning to spend significantly more on IT technology (primarily to combat cyber threats), strategic M&A, as-needed restructuring, developing competitive products, and R&D investments.

But CFOs are also planning on spending significantly less on a few key areas, namely Finance, Marketing, Human Resources, and GS&A:

Source: The Digital Future of Finance (Gartner)

There’s a lot to unpack here, but the major takeaway is very simple: automation will greatly impact many traditional functions, not just Finance. Automated workflows and operational efficiencies are here to stay because they lead to optimized workflows and spending. There’s no way to avoid implementing them.

But despite the doom-and-gloom from naysayers and industry purists, automation is not a bad thing at all. Far from it—smart spend management automation can help simplify labor- and time-intensive processes, reduce waste and revenue leakage, improve compliance, and reduce the risk of payment fraud.

The bottom line: Operational efficiencies free up Finance teams to focus on more meaningful, high-value work that drives their companies forward. In fact, modern accounts payable teams that switch to automated expense solutions spend far less time on data entry and reconciliation and save 25–40 hours per month.

Finance can finally cast off the tedious yoke of manual processes that stifle innovation and embrace a more strategic role as forward-thinking business partners that help make meaningful, data-driven decisions.

4. Finance cycles and self-service reporting approach “real-time”

In the era of remote work and collaboration, automated data aggregation, and increasing business intelligence, decision-makers want answers to their questions faster than ever. They want it to be accurate, timely, and reliable. They also wanted it yesterday.

Unfortunately, “fast” doesn’t usually apply to the traditional reporting process. Many Finance teams are still slowed down by siloed and unreliable data, poor communication between teams, and sluggish periodic reporting.

But when up-to-date financials and expense data are automatically aggregated into a single, centralized “source of truth” that’s instantly available to anyone who needs it for self-service reporting, traditional accounting and AP cycle times start to look like horse-drawn carriages.

Real-time reporting is being able to build on-demand reports in hundreds of different ways. - Source

Take Montreal’s government, which started to adopt a real-time, non-periodic reporting solution for municipal finances all the way back in 2003. The large-scale system tracked 400,000 taxpayer accounts and over C$2.5 billion in annual receipts, allowing employees to generate over 500 pre-defined and customizable reports, which could be auto-generated and even distributed when certain conditions were met.

The bottom line: Being able to perform as-needed financial modeling and generate on-demand financial reports is financially transformative. Instead of waiting around for monthly or quarterly reports, Finance teams empowered by automation can realistically generate as-needed reports, speeding up Finance and AP cycle times and unlocking better business intelligence.

Not to mention that when cycle times go down, cost savings go up, and employees are doing their jobs better, everyone’s a winner. On-demand reporting means they’ll finally have the time (and data intelligence) to focus on high-impact problem-solving.

5. The workforce and workplace may never be the same

Due to the COVID-19 pandemic, 71% of Americans were working remotely by the end of 2020. Unsurprisingly, 54% of workers admitted they would prefer to work remotely after the pandemic ends. Employers will have a hard time denying these requests when remote workers are actually more productive.

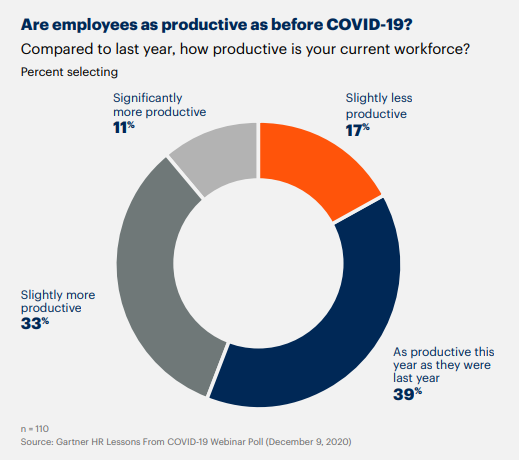

According to Gartner, only 17% of employers felt their employees had become “slightly less productive” from working remotely during the pandemic, while 44% of employers reported that their teams were “slightly more productive” or “significantly more productive”:

Source: The Digital Future of Finance (Gartner)

That’s why employers need to be prepared to handle the expectations of (and risks associated with) a remote workforce. The good news is that automated, cloud-based solutions make transitioning to remote work very feasible and manageable for forward-thinking Finance teams.

A study conducted by Emburse revealed that 98% of customers agreed that automating time-consuming manual tasks made it much easier to support and monitor a remote workforce. Companies that move their Finance function online often see significant decreases in processing costs and turnaround times, too.

Of course, implementing new technologies is still much easier than reimagining and changing your talent model. But that’s exactly what many Finance leaders are faced with in this brave new world of remote work and cloud-based data.

The Finance function is becoming more centralized in order to drive operational efficiencies and enable data-driven decision-making, yet offices are becoming more decentralized. This ongoing digital transformation is flipping the workplace on its head.

At the same time, the workforce has never looked so different. Finance professionals with specific expertise—like data scientists, business analysts, and storytellers—are in more demand than ever before. Qualities like strong customer service skills, familiarity with technology, and the ability to collaborate and form committees with teams outside of Finance will be crucial.

The bottom line: If Finance leaders want to become strategic partners in their organizations, they need to get on board with remote and hybrid work trends. This means optimizing their tech stack to support remote workers and upskilling their existing workforce to be more productive with digital solutions. It means making every new hire count.

More traditional Finance teams will also have to navigate how to effectively collaborate and communicate without being face to face. Of course, this is a lot easier when team members have access to a multi-device spend management platform that updates 24/7.

Don’t be left in the dark—the future of Finance is bright

No one has a crystal ball. None of us know for certain what the future will hold. We can only look at what’s happening now and do our best to prepare for what may come.

What we know for sure is that the years ahead will be full of unprecedented opportunities for Finance leaders willing to embrace technological innovation and cultural change. Now is the time to step back and make sure your organization’s financial roadmap is clear and free of obstacles.

For Finance, this means focusing on the following priorities:

- Optimize inefficient systems to unlock invaluable time and cost savings. Optimized Finance teams save anywhere from 20–40 hours per month simply by eliminating tedious manual tasks. By reducing waste and ensuring compliant spending (on autopilot), Finance teams can finally focus on strategic, high-value work for their organizations.

- Speed up finance workflows and cycle times. Smart automation enables self-service reporting. Enable team members to build budgets, prepare forecasts, and produce as-needed, on-demand reports. AP cycles will take less time, strengthening key vendor relationships.

- Improve expense data aggregation, transparency, and analysis. Bad financial data can incur millions of dollars in losses and poor decisions. Finance leaders must embrace data automation and predictive analytics to give themselves the time they need to arrive at actionable insights that lead to better, data-driven decisions.

- Replace legacy ERP systems with specialized financial apps and services. The days of on-premise server migrations, sluggish customer support, and “what you see is what you get” out-of-the-box solutions are long gone. Cloud-based financial solutions and expense management platforms deliver exceptional ROI.

- Pivot to support a remote workforce with more complex and strategic roles. AP clerks and accountants will always have their place, but the Finance teams of the future will need data scientists and storytellers who can help decision-makers achieve consensus. Hiring and supporting remote talent is key to success.

Are your current finance and expense management solutions helping your organization stay competitive in 2022 and beyond? If not, maybe it’s time they did.

Help Transform My Finance Team ➔

Search

Subscribe

Latest Posts

- Driving AP Success With Automation Part 3: How to Save Time and Money While Increasing Compliance

- Driving AP Success With Automation Part 2: How to Create More Efficient Processes With AP Automation

- VAT IT Partners With Emburse to Help Companies Save 27% on Expenses

- Driving Success With Automation Part 1: 4 Common AP Management Bottlenecks

- The Future of Finance: 5 Predictions For Digital Transformation in 2022 And Beyond

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.