Ways to Reduce Regulatory Risks

The right expense management software can help reduce compliance risks and improve operational efficiency by using automation, electronic payments and analytics to increase transparency.

For CFOsTop 5 Warning Signs of Expense Fraud

Providing corporate credit cards to employees has many financial and operational benefits, and it helps streamline travel expense management. Using corporate credit cards tends to reduce expense report fraud, but you’ll still need to keep an eye out for employees trying to beat the system.

Expense Management, Fraud5 Ways Travel Expense Management Pays Off for Your Business

Companies can reduce annual travel and entertainment (T&E) costs by 7 percent to 15 percent by using a comprehensive travel expense management system, according to a recent article on the Spend Matters website.

Expense Management5 Reasons the Cheapest Expense Management Option Isn’t Always the Best Value

An employee has received approval to attend an important conference — her first trip on the company’s dime. “Just email me the flight details, and I’ll pay for it with a company credit card,” her supervisor says. Knowing the travel budget is tight, the employee submits the lowest fare. But her supervisor ultimately books a slightly more expensive ticket after identifying a better flight that avoids a long layover on an airline that offers the company a volume discount.

Expense Management6 Tips for Unlocking Big Data With Expense Management Software

To reveal hidden trends and opportunities, companies can use analytics software to sift enormous amounts of data, looking for an edge. As businesses seek to benefit from “big data,” managers increasingly rely on analytics-based reports to guide their decision-making, according to a post on the Big Fat Finance Blog. A great way for your company to benefit from big-data analytics is by using expense management software.

Expense Analytics and Reporting, Expense Management4 Tips to Invigorate Yourself to Get Through the “Busy Season”

With the exception of the New Year, spring is the time of year when we have more motivation for positive change than any other time. Many of us are often motivated to start self-improvements like a new diet, getting in better shape, cutting out processed foods, and getting more sleep. But those of us involved with the world of accounting and corporate finance struggle with an additional factor this time of year. You guessed it, “busy season!” Whether you’re a tax accountant slugging your way toward April 15 or you’re in corporate finance and working to finalize Q1 reporting for your organization, you probably don’t seem to have a spare second for even the most basic routines, let alone time for a new health kick! But by not taking care of ourselves, aren’t we actually hurting our productivity? There are reams of health statistics and studies that show we are.

Expense Management3 Tips for Simplifying Large-Group Travel Expense

While packing for your morning flight out of Austin, you triple-check your briefcase for the receipts you’ve collected while visiting a client. This time, you hope, it won’t take quite so long to fill out your expense report. One receipt turns out to be a formidable bill from the first night — a business dinner with your team of four, plus eight guests. Or was it nine guests? The week-old receipt already seems faded and hard to read.

Expense ManagementAvoid Sticker Shock Tomorrow by Tracking Business Expenses Today

It’s tempting to think of many business expenses as an investment: You buy a tool and use it to create a valuable product or service, and it generates revenue. But a whole lot tends to happen between that initial purchase and your return on the investment. Tracking business expenses is the best way to gain an accurate understanding of the total costs and really know whether you’re making money or not.

Expense ManagementDiscover 3 Ways Invoice Management Drives Down Costs

As the economy recovers, companies may find vendors increasingly reluctant to accept long payment terms that stretch out 45, 60, or 90 days. And when one of your oldest, most trusted vendors requests 30-day terms, it’s important to keep the peace rather than risk disruptions. Instead, organizations can save by using automated invoice management to increase efficiency, prevent costly errors, and secure favorable terms from vendors.

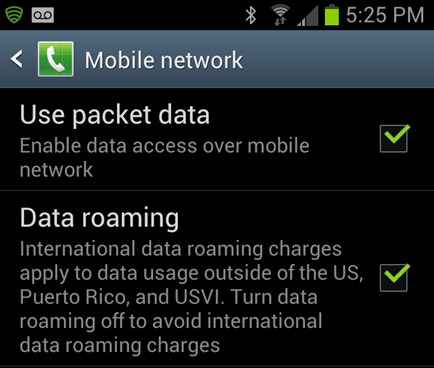

Invoice ManagementHave You Experienced Mobile Sticker Shock?

Depending on your company’s policy, you might find expense reimbursement for mobile phone bills to be one of the most contentious topics for expense approval. Most companies have a cap on what they will reimburse each month, and it’s not unusual for employees to accidentally get hit with a bill that is way beyond what they expected.

Expense Management, Expense ReportsSearch

Subscribe

Latest Posts

- Driving AP Success With Automation Part 3: How to Save Time and Money While Increasing Compliance

- Driving AP Success With Automation Part 2: How to Create More Efficient Processes With AP Automation

- VAT IT Partners With Emburse to Help Companies Save 27% on Expenses

- Driving Success With Automation Part 1: 4 Common AP Management Bottlenecks

- The Future of Finance: 5 Predictions For Digital Transformation in 2022 And Beyond

Posts by Category

Our choice of Chrome River EXPENSE was made in part due to the very user-friendly interface, easy configurability, and the clear commitment to impactful customer service – all aspects in which Chrome River was the clear winner. While Chrome River is not as large as some of the other vendors we considered, we found that to be a benefit and our due diligence showed that it could support us as well as any large players in the space, along with a personalized level of customer care.

We are excited to be able to enforce much more stringent compliance to our expense guidelines and significantly enhance our expense reporting and analytics. By automating these processes, we will be able to free up AP time formerly spent on manual administrative tasks, and enhance the role by being much more strategic.