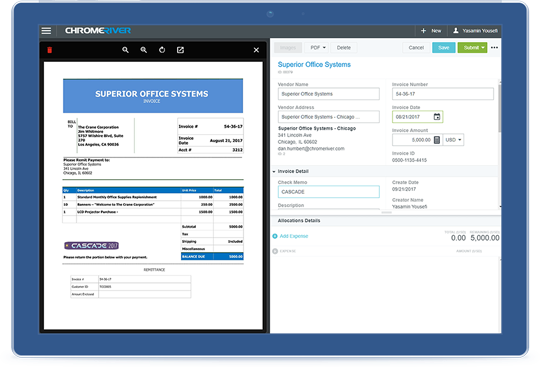

Modernize the way you manage invoices

Invoice management can be a time-consuming and complex process for many organizations. That's typically attributed to legacy methods that choke productivity. Emburse Chrome River Invoice elevates your AP team's role from paper chasers to agile strategic advisors.

- Enable your AP team to focus on more valuable business needs

- Expedite every step of your invoice management process

- Keep ahead of vendor payments

- Improve accuracy and visibility

- Uncover savings opportunities otherwise hidden by a chaotic process

100% of customers who previously used Concur rated Chrome River's built-in business rules engine as better than Concur's.

Make your AP process work for you

Invoice makes it easy to transform your current process into one that benefits multiple touchpoints for the organization. Your suppliers stay informed. Your approvers thrive with custom workflows and a built-in rules engine. Most importantly, your AP team will love that they have more time to flex their investigative brain.

Reduce operational costs

Legacy AP tasks like manually keying information, chasing approvals, and answering vendor payment inquiry calls eat up valuable time. The impact to accuracy and productivity results in in higher operational costs.

Chrome River Invoice's automation tools, like OCR vision and Catalog Punchout, simplify every step of your process to improve efficiency while saving the organization money.

Prevent duplicate or late payments

Manual invoice processing limits your organization's ability to detect duplicate or late payments, which could lead to overpayment.

Standard features in Emburse's enteprise invoice management software from Chrome River - like optical character recognition (OCR), two and three-way matching, and a fully customizable business rules engine -make certainty a defining quality of your process.

Optimize spend more strategically

Without precise invoice data, it's difficult to track where your cash goes or ensure you're getting the best possible deals. The integrity of invoice data can also suffer if you depend on error-prone manual entry.

With Invoice's built-in tools, you expand visibility and accuracy to predict cash flow while also identifying additional discount opportunities.

Prevent fraudulent and out-of-policy spend

AP processes without proper controls for compliance expose your organization to fraud or out-of-policy spend, as well as costly audits and penalties. The potential for fraud multiples if your organization cuts checks for its invoice payments.

Invoice's business rules engine automates compliance for you. Its configurability ensures that even the most complex approval workflows can be mirrored while narrowing the potential for fraud.